top of page

Medicare 101

MEDICARE EXCESS CHARGES EXPLAINED

Both Medicare Supplement/Medigap Plan G and Plan F, specifically, Medigap Plan F and Plan G, protect you from these additional, unnecessary fees and costs. BY eliminating Medicare Part B Excess Charges, your medicare bills stay predictable, and you can rest easy without fear of having a big surprise Healthcare bill.

WHY YOUR INITIAL MEDICARE CHOICES ARE SO IMPORTANT

Michael T. Braden February 13, 2026 ENROLLING IN MEDICARE HOW YOUR MEDICARE DECISIONS MATTER Hi, and welcome to our latest Medicare Blog Article. Today, we are going to explain why the first choice you make when you first enroll in Medicare is essential to protecting your healthcare and your finances throughout your retirement. Photo Of Braden Medicare Insurance' We Only Get One Chance To Make A Good First Impression With Medicare Poster.pdf Remember the saying "You only g

THE MEDICARE DECISIONS YOU MAKE MATTER

Hi, and welcome to our latest Medicare Blog Article. Today, we are going to explain why the first choice you make when you first enroll in Medicare is essential to protecting your healthcare and your finances throughout your retirement.

YOUR ROADMAP FOR ENROLLING IN MEDICARE

Most people do not realize that Medicare is the National Health Insurance program for Americans 65 years of age and older, as well as those who have been granted a full-time disability by the Social Security Administration. Medicare is not for the Poor or Homeless. Medicaid is health insurance for individuals whose income is below national guidelines, and for those who need extra help. Medicare is the best option for individuals when they reach age 65.

SEPARATING MEDICARE MYTHS FROM MEDICARE FACTS

There are a large number of well-intended individuals who seem to think they know everything about everything; in fact, you may even know someone who fits the bill. However, when it comes to Medicare, the initial choices you make are extremely important to your future healthcare, and it would be a shame to rely on hearsay or Myths that are not true.

WHAT ARE THE MAXIMUM-OUT-OF-POCKET (MOOP) EXPENSES WITH MEDICARE?

In this article, we explain what the Medicare out-of-pocket maximum really means, how it works across different types of Medicare coverage, and how you can better insulate yourself from unexpected medical bills.

MEDIGAP PLAN F, vs PLAN G, vs PLAN N

Medicare Supplement Plans F, G, and N are the three most popular Medigap Plans in the United States. Plan F has long been the Cadillac of Medigap Plans, but is now available only to those who turned 65 before January 1, 2020.

Even though they have higher Out-Of-Pocket costs, Plan G and Plan N are more cost-effective than Plan F.

MEDICARE RELEASES PREMIUM COSTS FOR 2026

Navigating the world of Medicare can sometimes feel overwhelming, especially when the costs change each year. Understanding these adjustments is essential for budgeting and

The official 2026 numbers have been released by the Centers for Medicare & Medicaid Services (CMS). We are here to walk you through these new costs, explain what they mean for you, and show you how to manage them effectively.

ALL ABOUT MEDICARE SUPPLEMENTS IN AMERICA

A little over 50% of Medicare Beneficiaries have Medicare Supplement/Medigap Insurance, often called Medigap Insurance. These policies are designed to work alongside your Original Medicare benefits, covering the financial gaps that Original Medicare leaves behind. Historically, beneficiaries had a wide array of lettered plans to choose from, each offering a different level of standardized coverage. This standardization ensures that a Plan G from one carrier offers the same be

DID YOU KNOW THIS ABOUT MEDICARE SUPPLEMENT PLANS

While you may know these plans help cover copayments, coinsurance, and deductibles, several lesser-known features make this coverage even more valuable. Understanding these nuances can help you make a more informed decision about your healthcare future. Here are five surprising facts about Medigap that might change how you view your coverage options.

Navigating the Medicare Annual Enrollment Period

The Medicare enrollment period is a designated time each year when beneficiaries can make changes to their Medicare coverage. This period typically runs from October 15 to December 7 annually. During this time, you can:

Switch from Original Medicare to a Medicare Advantage plan.

Change from one Medicare Advantage plan to another.

Enroll in a Medicare Part D prescription drug plan.

Drop your Medicare prescription drug coverage.

WHAT IS THE BEST OPTION: MEDICARE ADVANTAGE OR ORIGINAL MEDICARE WITH A MEDICARE SUPPLEMENT PLAN

MEDICARE SUPPLEMENT vs MEDICARE ADVANTAGE, which option is better? This has been an ongoing battle for decades and will continue for the foreseeable future.

It is one of the most common and confusing decisions people face when enrolling in Medicare.

MEDICARE & PRE-EXISTING CONDITIONS

In today's article, we will discuss and explain what pre-existing conditions are covered and accepted by Medicare. Yes, Medicare does cover pre-existing medical conditions. From the moment you enroll, Medicare ensures that you receive the treatment and care you need, regardless of your health. However, certain exceptions and specifics apply depending on the type of Medicare plan you choose.

HOW DO YOU FIND THE BEST MEDICARE PLAN?

Medicare can be confusing, but as soon as you understand the different parts of Medicare and how they work together, it all makes sense in short order

THE TOP 10 MEDICARE MISTAKES TO AVOID

UNDERSTANDING AND AVOIDING THE TOP 10 MEDICARE MISTAKES FOR NEW MEDICARE BENEFICIARIES

WHAT MEDICARE WILL COST IN 2026

Understanding the wonderful, wacky world of Medicare can often feel overwhelming, especially when the costs change each year. Understanding these adjustments is essential for budgeting and ensuring appropriate coverage for your healthcare needs.

WHAT WILL MEDICARE COST IN 2026

WHAT COSTS ARE COVERED BY MEDICARE

When we talk about “Medicare costs,” we are generally referring to a few different types of payments you might make:

Such as: Premiums, Deductibles, Co-Pays & Co-I

CHOOSING THE RIGHT MEDICARE PART D PRESCRIPTION DRUG PLAN

HELPING YOU TO UNDERSTAND MEDICARE PDP PLANS

Prescription drug plans help cover the costs of medications not included in original Medicare. They are offered by private insurance companies that contract with the Medicare program. These plans may come with various premiums, deductibles, and copayments. It's essential to understand how these different components work to select the most beneficial plan.

WHY UNDERSTANDING MEDICARE IS GOOD FOR EVERYONE

Selecting the best Medicare plan depends on your health needs, budget, and preferences. Here are some practical tips:

Assess Your Health Needs: Consider your current health status, medications, and preferred doctors.

Compare Costs: Review premiums, deductibles, copayments, and out-of-pocket maximums.

Check Provider Networks: Ensure your doctors and hospitals are in the plan's network.

Review Extra Benefits: Some plans offer vision, dental, hearing, or wellness programs.

HOW DO YOU CHOOSE THE RIGHT MEDICARE PLAN FOR YOU AND YOUR NEEDS

THE QUESTION "HOW TO CHOOSE THE RIGHT MEDICARE PLAN FOR YOU AND YOUR NEEDS" MAY SOUND SIMPLE, BUT IT IS SO TRUE. YOU NEVER WANT TO GET A PLAN BASED ON OTHER PEOPLE'S RECOMMENDATIONS, BECAUSE OTHER PEOPLE AREN'T YOU.

NAVIGATING MEDICARE: WHAT YOU NEED TO KNOW

S MEDICARE FREE WHEN YOU TURN 65?

Many people wonder about the costs associated with Medicare after reaching 65. The short answer is: no, Medicare is not entirely free of charge. Here’s a breakdown of expected expenses:

Part A Costs: Most people do not pay a premium for Part A because they have paid Medicare taxes throughout their working years. However, some may be required to pay a premium if they do not qualify based on their work history.

Part B Costs: Part B requires a

MAXIMIZE BENEFITS DURING THE MEDICARE ANNUAL ENROLLMENT PERIOD

UNDERSTANDING MEDICARE ENROLLMENT DEADLINES

Medicare enrollment deadlines are specific periods when you can sign up for or make changes to your Medicare coverage. These deadlines are crucial because they determine when you can enroll in Medicare Part A (hospital insurance), Part B (medical insurance), Part C (Medicare Advantage), and Part D (prescription drug coverage).

Here are the main enrollment periods to keep in mind:

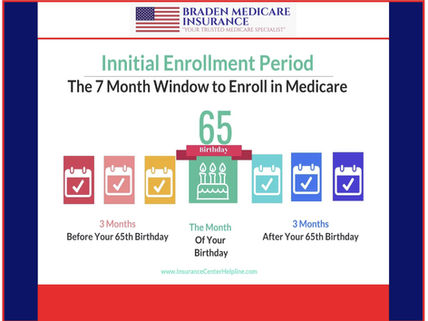

Initial Enrollment Period (IEP): This is a

UNPACKING MEDICARE: COVERAGE, BENEFITS, AND YOUR OPTIONS

Understanding health coverage options can be overwhelming, especially when it comes to Medicare. This federal program provides essential health insurance to millions of Americans, primarily those aged 65 and older, as well as certain individuals with disabilities younger than 65. Knowing what Medicare covers, the benefits it offers, and the choices available can help you make informed decisions about your healthcare.

Medicare and Federal Employee Benefits

How Medicare Works with Your FEHB (Federal Employee Health Benefits)

Many individuals working for Governmental Agencies or Departments have Federal Employee Health Benefits (FEHB). This article explains how Medicare interacts with FEHB plans and what federal employees should know about aligning their benefits with Medicare.

MAKING SENSE OUT OF MEDICARE

We wrote this to help you better understand Medicare concisely and transparently.

Medicare consists of four parts. Medicare Part A, Part B, Part C, and Part D

MEDICARE PART A - Pays for Inpatient Hospitalization, Hospice, and Skilled Nursing Care.

MEDICARE PART B - Pays for outpatient doctor visits, Lab Tests, Screenings, and DME.

MEDICARE PART C - Is Medicare Advantage

MEDICARE PART D - Covers Prescription Medications.

THE MEDICARE ANNUAL ENROLLMENT PERIOD STARTS OCTOBER 15th

The Medicare AEP (Annual Enrollment Period) runs from October 15th through December 7th every year. During AEP, about 48 million Medicare Beneficiaries will make at least one change to their Healthcare portfolio for the 2026 Plan Year.

The Medicare Annual Enrollment Period (AEP) occurs each fall. During the AEP, Medicare beneficiaries can change their current Medicare Advantage Plan or their Stand-Alone Medicare Part D Prescription Drug Plan.

ARE ALL MEDICARE ADVANTAGE PLANS BAD

WHY ARE MEDICARE ADVANTAGE PLANS BAD?

Misinformation and a lack of understanding can lead to Medicare Advantage nightmares. So, we are here to help clear the air. Medicare Advantage plans are not always problematic. However, they are certainly not a good fit for everyone. You should only enroll in Medicare Advantage coverage if it is the best fit for your unique situation. Below, we clarify why these seemingly too-good-to-be-true plans have a less-than-stellar reputation an

MEDICARE PART B EXCESS CHARGES EXPLAINED

The easiest way to avoid excess charges is to use physicians who accept Medicare assignment. You will never be billed more than Medicare allows for your healthcare services. It’s always a good idea to ask your doctor if they accept assignment before you make an appointment. Don’t forget to ask the same question of any Medicare provider, such as lab facilities and home health care companies.

You can also find providers in your area that participate with Medicare using the Med

WHAT IS MEDICARE EASY PAY

Once you start receiving Social Security benefits or Railroad Retirement benefits, Medicare premiums will be automatically deducted from those payments. But until then, you may be better off paying Medicare online by using Medicare’s automatically deducted monthly payment system called Easy Pay If you did not work enough quarters to qualify for Premium Free Medicare Part A, or if you are a High Wage Earner who has been assessed with an IRMAA surcharge, you will be billed for

WHAT IS THE BEST MEDICARE SUPPLEMENT PLAN FOR YOU

Looking for the Best Medicare Supplement Plan? The best plan for you is not always the cheapest plan. However, working with a Certified Medicare Planner like Michael Braden at Braden Medicare Insurance is a great start,

MEDICARE CHANGES IN 2026

Thankfully, there are not nearly as many new concerns as last fall, but I think it's still good to share the information. The most significant nationwide trend is that healthcare costs continue to rise rather than level off. We have seen that MOOP amounts continue to increase, along with Medicare Advantage, Part B Premiums, Part B Deductibles, Medicare Supplement Premiums, and Medicare Part D Deductibles.

YOUR FIRST 90 DAYS WITH MEDICARE

Once you’re enrolled in Parts A and B, the next step is determining how you want to receive your benefits. You have two primary options: stick with Original Medicare, which allows you to visit any provider and any hospital in the US, or choose Medicare Part C, also known as Medicare Advantage, which bundles hospital, medical, and often drug coverage into one plan.

WHAT IS MEDICARE?

Medicare is the most widely used health insurance program for individuals aged 65 and older. If you are nearing eligibility, it is essential to understand what Medicare is and how its four parts work.

However, Medicare does not cover everything. You may need to enroll in additional plans to obtain full coverage.

WHAT DO I DO WHEN MY MEDIGAP PLAN HAS A RATE INCREASE?

Everything you need to know about Medicare Supplement Insurance plans, including how to change plans and keep your premiums as low as possible which is very important as we age.

What Are Medicare Advantage Plans

What are Medicare Advantage Plans? Medicare Advantage Plans cover all Medicare services. Some Medicare Advantage Plans also offer extra coverage, such as vision, hearing, and dental coverage.

Did You Know That Medicare Supplement Plans & Medigap Plans Are The Same Thing?

Perhaps the most significant benefit is choice and portability. A Medicare Supplement or Medigap plan allows you to choose ANY Doctor, go to ANY Hospital ANYWHERE in the United States, and you are covered, as long as the Doctor and Hospital both accept Medicare's Assignment/Fee Structure.

Medicare Part D Explained

MEDICARE PRESCRIPTION DRUG PLANS

You must be enrolled in Medicare Part A and/or Part B to be eligible to enroll in Part D. Medicare drug coverage is only available through private plans. If you have Medicare Part A and/or Part B and you do not have other drug coverage (creditable coverage), you should enroll in a Part D plan.

If You Are New To Medicare And Do Not Understand What Medicare Is All About, Start Here

Getting older can be challenging. The healthcare options available to you may seem confusing or unnecessary. Your inexperience in this new chapter, coupled with ongoing health concerns, creates a recipe for disaster. With age comes wisdom, and knowing how to navigate the system will demonstrate it. Getting the coverage and protection that you need is much easier than it seems. Here are three essential parts of enrolling in Medicare that will help guide you through the p

How Medicare Supplement Plans Work

A Medicare Supplement plan is an excellent option for people who prefer the government-run Medicare program but want a few more of their costs covered. This article explains what a Medicare Supplement plan is, how it works, the benefits each plan offers, and mo

The ABC'S Of Medicare

Both Medicare Part A and Medicare Part B are 80% government-paid, with the remaining 20% borne by the beneficiary or patient. With Original Medicare, you are free to choose a Doctor or Hospital that accepts Medicare Terms for payment. (Approximately 94% of all Doctors accept Medicare.

How Do You Find the Best Medicare Part D Drug Plan?

The best way to compare Drug plans for your specific medications is to speak with your Medicare Broker. They typically can offer plans from multiple Insurance companies. Here at Braden Medicare, we are contracted with every Medicare Part D Plan in Arizona. They will compare your medications, whether you have Original Medicare with a Stand-Alone Medicare Part D Drug Plan or a Medicare Advantage Plan that includes Prescription Drugs.

Medicare Is Not Medicaid and Medicaid Is Not Medicare, But Some People Can Qualify For Both

However, there is a stark difference. Medicare is the National Health Insurance Program for Americans age 65 and over, as well as those with ALS or Renal Failure, or those who have been issued a Disability designation by the Social Security Administration. Medicaid operates at the state level and helps provide Health Care and other vital services to low-income individuals, seniors, single mothers, and children.

Medicare Advantage HMO Plans

Medicare HMOs are common because of the lower premiums they often offer. In some plans, that premium may be as low as $0. However, you must remain enrolled in and pay for Medicare Part B. You usually must also use in-network providers, except in an emergency.

MEDICARE ADVANTAGE HMO PLANS = MEDICARE HEALTH MAINTENANCE ORGANIZATION PLANS

In HMO Plans, you generally must get your care and services from providers in the plan's network, except:

Everything You Need To Know About Medicare Part D Drug Plans

Each plan that offers prescription drug coverage under Medicare Part D must provide at least the standard level of coverage set by Medicare. Plans can vary the list of prescription drugs they cover (called a formulary) and how they place drugs into different "tiers" on their formularies. (A formulary is a listing of all of the drugs/medications that a particular plan has available to its members. All Medicare Part D Plans must have two drugs available in each category.

Everything You Need To Know About Medicare

Everything you need to know about Medicare starts here: there are three ways to receive Medicare coverage: Original Medicare, Medicare Advantage, and Medicare Part D. Each option has its own benefits and costs.

WHICH MEDIGAP PLAN SHOULD I CHOOSE?

Plans F and G are the most popular Medigap plans because they take away ugly healthcare billing surprises. High-deductible F and G Medigap plans do the same thing, but choosing these plans means you have to have enough savings to pay the annual deductible upfront.

Braden Medicare Insurance' Top 10 Most Frequently Asked Questions About Medicare

Original Medicare includes Medicare Part A (Hospital Insurance) and Medicare Part B (Medical Insurance). The Government pays for 80% of all Medicare-covered and Medically Necessary procedures, while you, the Medicare Beneficiary, pa for the other 20% of health services not paid for by Medicare. You typically pay for services as you receive them. When you get services, you’ll pay a deductible at the start of each year, and you usually pay 20% of the cost of the Medicare-ap

Making Sense Out Of Medicare

What makes matters confusing to the public is that it is different from any Healthcare we have ever had, and it uses words, concepts, and acronyms we have never seen or heard of before. However, once you have a chance to work with someone who not only understands Medicare but also has the requisite skills and attributes to teach and explain it to others, it becomes much less daunting. In this article, I have tried to encapsulate Medicare in a basic but friendly format that

What You Need To Know If You Plan On Working Past Age 65

If you’re 65 or older, you are eligible for Medicare. You may elect employer coverage instead of Medicare if you or your spouse is actively employed and your employer offers creditable coverage. Generally, if your employer has more than 20 employees, Medicare considers its Group Health Plan creditable. If your employer has fewer than 20 employees, Medicare does not consider your Group Health Plan creditable coverage. In this case, you should consider dropping your plan and en

Everything You Need To Know About Medicare Supplement Plan G

Currently, and since 2020, Medicare Supplement Plan G has been the most popular and the most purchased Medicare Supplement plan, and it is not even close. As of January 1, 2020, Medicare Supplement Plan F was the most popular plan; however, it is no longer available to anyone who was not 65 before 1/1/2020. Since then, Plan G has taken over.

Understanding How Medicare Advantage Special Needs Plans Work

The reason Special Needs Plans exist is to better serve individuals with a Team approach to their care. Having multiple "Specialists" in their networks is vital to these individuals receiving the best possible care possible. It is also an efficient way to coordinate resources for the Insurance companies. Medicare SNPs typically have specialists in the diseases or conditions that affect their members.

bottom of page

_AZ_Initial.png)