Michael T. Braden September 8, 2025 MEDICARE 101

Understanding health coverage options can be overwhelming, especially when it comes to Medicare. This federal program provides essential health insurance for millions of Americans, primarily those aged 65 and older, as well as specific individuals with disabilities who are younger than 65. Knowing what Medicare covers, the benefits it offers, and the choices available can help you make informed decisions about your healthcare.

UNPACKING MEDICARE: COVERAGE, BENEFITS, AND YOUR OPTIONS

EXPLORING MEDICARE HEALTH COVERAGE: WHAT YOU NEED TO KNOW ABOUT UNPACKING MEDICARE

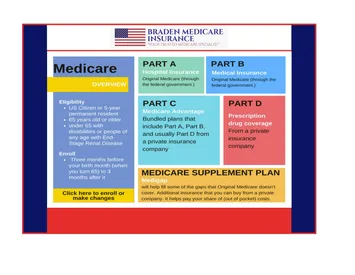

Medicare is divided into different parts, each designed to cover specific healthcare services. Here’s a breakdown of the main components:

- Part A (Hospital Insurance): Covers inpatient hospital stays, skilled nursing facility care, hospice, and some home health care.

- Part B (Medical Insurance): Covers outpatient care, doctor visits, preventive services, and some home health care.

- Part C (Medicare Advantage): An alternative to Original Medicare (Parts A and B) offered by private companies. These plans often include additional benefits, such as vision, dental, and prescription drug coverage.

- Part D (Prescription Drug Coverage): Helps cover the cost of prescription medications.

Each part has its own costs, including premiums, deductibles, and copayments. For example, Part A is usually premium-free if you or your spouse paid Medicare taxes while working. Part B requires a monthly premium, which varies based on income.

Choosing the right combination depends on your health needs, budget, and preferences. Many people opt for Original Medicare (Parts A and B) and add a Part D plan for drug coverage. Others prefer Medicare Advantage plans for more comprehensive benefits.

Hospital entrance representing Medicare Part A coverage

HOW TO MAXIMIZE YOUR MEDICARE HEALTH COVERAGE BENEFITS

Medicare offers several benefits that can significantly reduce your healthcare expenses. Here are some key advantages and tips to get the most out of your coverage:

- Preventive Services: Medicare covers many preventive services at no additional cost, including flu shots, cancer screenings, and annual wellness visits. Taking advantage of these can help detect health issues early.

- Access to a Wide Network of Providers: Original Medicare allows you to see any doctor or specialist who accepts Medicare. Medicare Advantage plans may have network restrictions, but often include extra perks.

- Prescription Drug Savings: Part D plans help lower the cost of medications, which can be a significant expense for many seniors.

- Financial Protection: Medicare limits your out-of-pocket costs, protecting you from catastrophic medical bills.

To maximize benefits, review your plan annually during the open enrollment period. Compare costs, coverage, and provider networks to ensure your plan continues to meet your needs. Also, consider supplemental Medigap policies to cover gaps in Original Medicare, such as copayments and deductibles.

Prescription medications representing Medicare Part D coverage

SIX THINGS NOT COVERED BY ORIGINAL MEDICARE

While Medicare provides broad coverage, there are essential services and items it does not cover. Being aware of these can help you plan for additional insurance or out-of-pocket expenses:

- Long-Term Care: Medicare does not cover custodial care in nursing homes or assisted living facilities if that is the only care you need.

- Most Dental Care: Routine dental exams, cleanings, fillings, dentures, and other dental services are generally not covered.

- Eye Exams and Glasses: Medicare does not cover routine eye exams for glasses or contact lenses, though it may cover some eye care related to diseases.

- Hearing Aids: Hearing exams and hearing aids are not covered under Original Medicare.

- Cosmetic Surgery: Procedures done for cosmetic reasons are excluded unless medically necessary.

- Routine Foot Care: Basic foot care, like nail trimming and treatment of corns or calluses, is not covered.

Knowing these exclusions can help you decide if you need additional coverage, such as dental or vision insurance, or a Medicare Advantage plan that includes these benefits.

Dental clinic waiting area illustrating services not covered by Medicare.

HOW TO CHOOSE THE BEST MEDICARE HEALTH PLAN FOR YOU

Selecting the best Medicare plan involves evaluating your health needs, budget, and lifestyle to determine the most suitable option. Here are some steps to guide your decision:

- Assess Your Healthcare Needs: Consider your current health status, medications, and preferred healthcare providers or facilities.

- Compare Plan Options: Look at Original Medicare versus Medicare Advantage plans. Check what each plan covers, its costs, and the provider networks it offers.

- Check Prescription Drug Coverage: If you take medications regularly, review Part D plans for formulary coverage and costs.

- Consider Supplemental Insurance: Medigap policies can help cover out-of-pocket expenses not paid by Original Medicare.

- Review Annual Changes: Plans can change benefits and costs yearly, so review your options during open enrollment.

Using online tools and consulting with licensed Medicare advisors can simplify this process. They can help you understand plan details and find options tailored to your needs.

ENROLLMENT TIPS AND AVOIDING MEDICARE PENALTIES

Enrolling in Medicare at the right time is crucial to avoid late enrollment penalties and coverage gaps. Here are some essential enrollment tips:

- Initial Enrollment Period: Begins three months before you turn 65 and lasts for seven months. Enroll during this time to avoid penalties.

- Special Enrollment Periods: Available if you have other coverage through your employer or experience certain life events.

- General Enrollment Period: From January 1 to March 31 each year, if you missed your initial enrollment.

- Avoid Late Enrollment Penalties: Delaying enrollment without qualifying for a special period can result in higher premiums.

Ensure you sign up for the parts of Medicare that best fit your situation. If you have employer coverage, coordinate with your benefits administrator to understand how Medicare works with your current insurance.

Understanding your options and the details of Medicare health coverage empowers you to make choices that protect your health and finances. Take the time to explore plans, ask questions, and stay informed to get the most from your Medicare benefits.