Inside this article, we focus on the differences between the two most popular Medigap Plans in the US, Medigap Plan G and Medigap Plan N.

Braden Medicare Insurance Poster Showing a Full Comparison Between Medicare Supplement Plan G and Medicare Supplement Plan N

- When comparing Medigap Plan N to Plan G, both offer substantial coverage benefits; however, there are more out-of-pocket costs associated with enrolling in Plan N.

- Plan G typically has higher premiums than Plan N, so you want to decide whether you want higher monthly premiums or if you prefer to reduce monthly premiums and pay copayments for specific doctor and emergency room visits.

- With Plan G, excess charges are fully covered, but with Plan N, you could be responsible for an additional 15% if you see a provider who charges more than the Medicare-approved amount.

When it comes to Medicare Supplement Insurance (Medigap), there are 10 standardized plans and two High Deductible Medigap plans available. Each plan covers specific healthcare costs not included in Original Medicare (Parts A and B). Among these plans, Medigap Plan G and its fellow high deductible version have exploded in popularity since Plan F and High Deductible F went away for newer beneficiaries.

Then, Medigap Plan N rose in popularity as one of the most sought-after plan options due to its comprehensive coverage and affordability.

However, some differences between the G and N can impact your healthcare expenses and decision about which is more suitable for you. In this article, we’ll compare Medigap Plan G vs Medigap Plan N to help you decide what best suits your needs.

MEDIGAP PLAN G OFFERS THE MOST COMPREHENSIVE COVERAGE AVAILABLE WITH PREDICTABLE COSTS

Since Original Medicare does not cover all your healthcare services and leaves you with out-of-pocket costs, many beneficiaries purchase additional insurance, such as a Medigap plan, to help with cost-sharing.

Medigap Plan G receives praise for its comprehensive coverage. It is a top choice for individuals seeking high financial protection against healthcare expenses.

One notable aspect of Medigap Plan G is that it does not cover the Medicare Part B deductible. In layperson’s terms, Plan G pays after Medicare A and B pay, except for the Part B deductible.

In 2025, the Part B deductible is $257, meaning you’ll need to pay this amount before Plan G covers your Part B expenses for the year. However, once you pay the deductible, you’ll be covered 100% between Medicare and Plan G for all approved services, leaving you with predictable and minimal out-of-pocket expenses.

THESE ARE ITEMS COVERED UNDER MEDICARE SUPPLEMENT PLAN G

Medicare Part A Deductible:

- Plan G covers the Medicare Part A deductible ($1,676 in 2025), which is the cost you’d typically pay out of pocket before your Medicare benefits kick in.

Medicare Part A Coinsurance and Hospital Costs:

- Plan G covers Part A copays and coinsurance, and an additional 365 days after Medicare benefits have been used.

Medicare Part B Coinsurance and Copayments:

- Since Part B pays 80% for approved services, Plan G pays the remaining 20% Part B coinsurance and copayments. Plan G ensures you have little to no out-of-pocket costs for outpatient services like doctor’s visits.

- Plan G covers the first three pints of blood needed for a medical procedure.

- If skilled nursing care is needed, Plan G pays the coinsurance for care received in a skilled nursing facility.

- Plan G covers the coinsurance or copayments for hospice care under Medicare Part A.

MEDICARE SUPPLEMENT PLAN N GIVES YOU COST SAVINGS WITH GREAT COVERAGE

While Plan G is considered more comprehensive, Medigap Plan N offers a more budget-friendly option for those who prefer to trade a few additional out-of-pocket costs for a lower premium.

WHAT IS COVERED BY PLAN N:

Like Plan G, Plan N covers coinsurance, deductibles, and additional hospital expenses under Medicare Part A, as well as hospice care, skilled nursing facility care coinsurance, and the first three pints of blood for a medical procedure.

Plan N also covers the remaining Part B coinsurance, but you will be responsible for some small copayments in addition to the Part B deductible.

THINGS NOT COVERED BY PLAN N:

Medigap Plan N has a few cost-sharing features that set it apart from Plan G. Let’s look at what costs you can expect to pay with Plan N:

Part B Deductible:

- You are responsible for paying your Medicare Part B Calendar Year Deductible, which is $257 in 2025.

Part B Excess Charges:

- Plan N does not cover Part B excess charges. These charges can occur if your healthcare provider charges more than the Medicare-approved amount. In this case, a provider can charge up to 15% more than the allowed amount, and you would be responsible for paying these excess charges yourself.

Outpatient Copays:

- While Plan N offers cost savings through lower monthly premiums compared to Plan G, it also incurs some out-of-pocket expenses when visiting healthcare providers. For certain office visits, you can expect to pay a copay of up to $ 20, and for emergency room visits, a copay of up to $50 may apply.

However, for many beneficiaries, these costs are manageable, and the savings on monthly premiums make Plan N an attractive choice.

HOW TO CHOOSE WHICH PLAN IS BEST FOR YOU BETWEEN PLAN N AND PLAN G

All lettered Medigap plans are standardized, no matter the carrier you choose. Each letter plan has the same medical benefits, regardless of which carrier you choose.

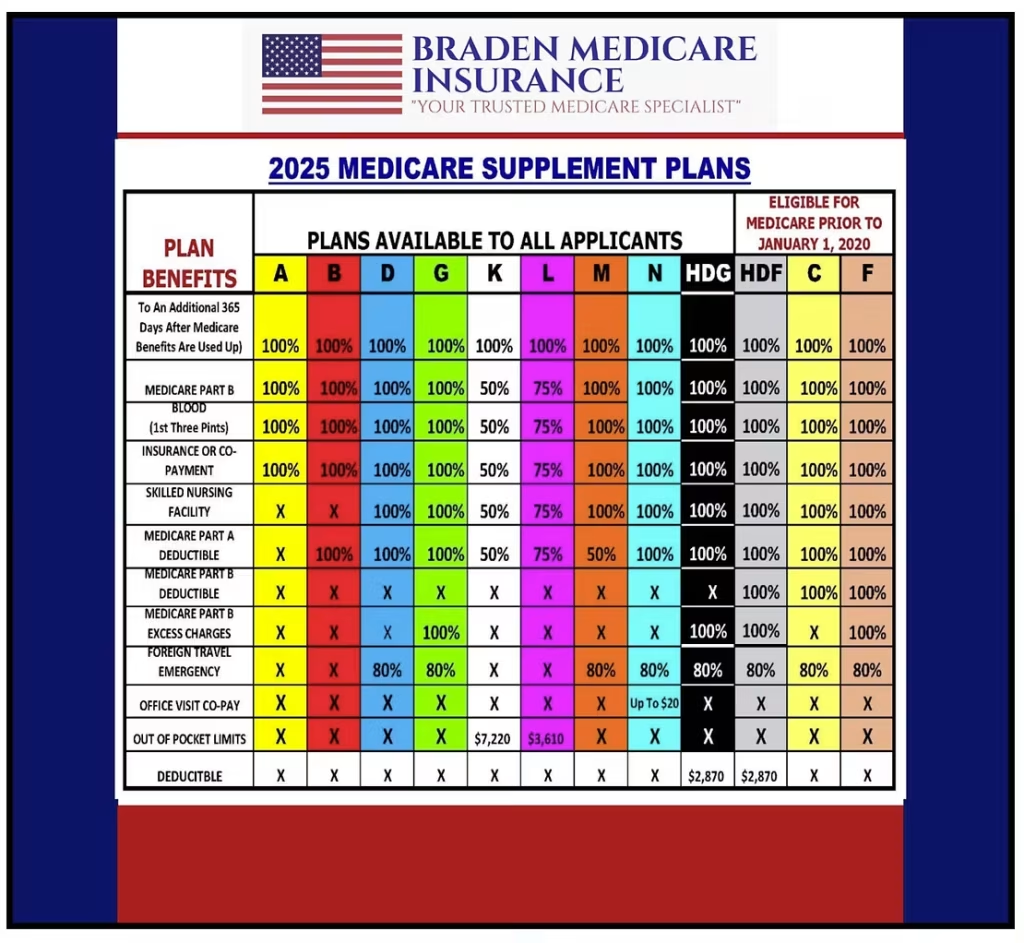

BRADEN MEDICARE INSURANCE 2025 MEDICARE SUPPLEMENT COMPARISON CHART

REMEMBER THESE KEY FACTS WHEN MAKING YOUR DECISION:

Budget:

Plan N may be more budget-friendly if you prefer lower monthly premiums. However, you will share some costs when you receive medical services.

Predictable Costs:

Suppose you value predictability in your healthcare expenses and don’t want to worry about copayments or the Part B deductible. In that case, Plan G offers comprehensive coverage with virtually no out-of-pocket costs once you meet the Part B deductible.

Part B Excess Charges:

If you want complete protection against Part B excess charges, Plan G covers these for you. If you live in a state that prohibits Part B excess charges, Plan N could be the choice for you.

Rate Increases:

Premium increases on Medigap plans are inevitable, but rate changes will vary among carriers. When selecting a carrier, consider the company’s rate-increase history and financial rating. Choose a carrier stable enough to manage claims and one that won’t dramatically increase your premium after one year.

DETERMINATING FACTORS

Ultimately, the best Medigap plan for you depends on your circumstances and preferences. You should carefully assess your healthcare needs and budget before making a decision.

Medigap Plan G and Plan N each offer unique advantages. The choice between them comes down to your financial priorities and healthcare requirements.

As a Medicare broker, we can provide expert guidance when comparing Plan G vs Plan N in your area. We strive to make the decision-making process more straightforward. Call us today and we’ll be happy to help!

Approximately 93.7% of all doctors accept Medicare’s fee structure, meaning they accept Medicare.

The main subset of doctors who do not accept Medicare are most typically:

- Pediatricians

- Psychiatrists

- Psychologists

- Naturopathic Doctors

- Homeopathic Doctors

WRAPPING THINGS UP

- If you prioritize comprehensive coverage and want to minimize out-of-pocket expenses, Plan G may be a more suitable choice for you.

- Plan N often has lower monthly premiums compared to Plan G, so if you’re comfortable with sharing some costs like copayments, Plan N may be a better option for you.

- You can always call your Doctor’s Office and ask them if they charge Copays for Medicare Supplement Office Visits and how much they charge. Many doctors never charge for this. There are 12 Different Codes Doctors can use for a Co-Pay, which is why it could range from $0 but cannot exceed $20.

- Over time, Medigap Plan N has had slightly lower premium increases than Plan G.

- Perhaps the most challenging thing to forecast is what you think you will want for your Healthcare 10, 15, and 20 years from now. If you wish to have the most predictable costs over time, Plan G may be a good choice. However, if you prefer saving $300-$400 per year now, then Plan N may be a better bargain over time.