Choosing the right Medicare Supplement plan is a crucial decision, especially for those new to Medicare who are faced with ten different plans. This can understandably lead to many questions and doubts. After reading this article, we hope you will feel more confident about the enrollment process and trust that the plan you choose is the best fit for your needs and budget—meaning it is the right plan for you.

Braden Medicare 2025 Medicare Supplement Side By Side Comparison Chart

- The right Medicare Supplement plan provides you with access to all of your doctors and fills in the gaps left over from Original Medicare.

- You can rest easy knowing that any doctor/provider who accepts Medicare is obligated to accept your Medicare Supplement Insurance, regardless of what company you choose to partner with.

- If you are married, most couples find comfort and confidence in having the same plan, even if it is not with the same carrier.

- The best thing and oftentimes the hardest thing to do is to look into the future and determine what you want to have in your Health Plan 10-20 years from now. A lot of things can happen, and sometimes life can deal you a setback that makes it impossible to change plans down the road. So, it has always been our experience to consider your risk tolerance and the monthly cost to help determine which plan is best for you from the jump.

- Remember, once you have a Medigap/Medicare Supplement policy, you own that policy. No one can ever take it away from you unless you have been more than 90 days without paying your premium. For example, if you choose a Plan N and then, in a few years, you want to switch to a Plan G, you can do that any day of the year; however, you will be subject to Underwriting and answering health questions. Before you get nervous, about 80% of all Underwriting cases are approved, but there is a chance that you could be turned down in the future, so choose wisely in the beginning.

The best Medicare Supplement plan is the one that gives you access to your chosen providers and covers the gaps in Medicare that you are most concerned about paying for. It also offers a competitive monthly premium compared to other plans in your area.

Often, when a person is new to Medicare, they feel overwhelmed by the numerous choices. In this post, we’ll walk you through a series of simple questions you can ask yourself that will help lead you to the best Medicare supplement plan for you.

In this article, we’ll focus on Medicare supplement plans, also known as Medigap plans.

If you are unsure of the disparities between the different types of Medicare plans, read about the differences between Medicare supplements and Medicare Advantage plans, and return to this page afterwards.

WILL YOUR DOCTOR ACCEPT YOUR PLAN?

As long as your doctor accepts Original Medicare, they will take any Medicare supplement. It doesn’t matter if that is a Medico Medicare supplement or a Humana Medicare Supplement. The chances that your doctor accepts Original Medicare are very good.

HAVE A QUESTION, OR WANT TO VERIFY IF ANY DOCTOR/PROVIDER ACCEPTS MEDICARE?

Call the Doctor or provider you want to see, whether you are looking for a new provider or if you have seen them before, you were enrolled in Medicare, and ask them if they “Accept Medicare“, 93.7% of the time you will hear a yes. The leading providers who do not accept Medicare’s Assignment (Assignment refers to Medicare’s fee schedule)are Psychiatrists, Psychologists, Naturopathic Doctors, Homeopathic Doctors, and Pediatricians.

WHAT ARE THE BEST COMPANIES TO PARTNER WITH?

Often, our clients ask us who offers the best Medicare supplement plans in terms of financial ratings or customer service. This will vary based on your state, as not all carriers do business in every state.

Some of the carriers that offer popular Medicare supplement plans are:

- Medico

- Mutual of Omaha

- Humana

- BCBS

- Manhattan Life

- CHUBB Insurance

- Aetna

- AARP

- Med Mutual Protect

IS ONE COMPANY BETTER THAN THE OTHER?

We give all Medicare supplements an A+ when it comes to claims payment. Before enrolling in Medicare, customer service played a significant role in your decision-making. Still, since Medicare is the primary payer, you will likely have little to no interaction with your Medigap carrier.

This is because MEDICARE decides what charges are legitimate and what is covered. Then, Medicare pays the 80% it owes to your doctor/provider. Then they notify your Medicare Supplement company to pay their 20% share, after verifying that your Annual Part B deductible has been met for the current Calendar Year.

Your Medicare Broker/Agent will always be more helpful than a nameless, faceless customer service representative at your insurance carrier.

We work with all the top Medicare supplement plans in every market. We can help you determine which option makes the most sense for you based on all of the data and financial information we have on all carriers.

WHAT IS YOUR TOLERANCE TO RISK

We work with clients of all shapes and sizes. Many have had to assist their aging parents and have often seen the high cost of healthcare up close and personal.

Ed, one of our clients, relayed his experience and costs when his wife was diagnosed with Breast Cancer. Even with his Employer Group Health Insurance, the amount of money they paid for the Chemotherapy and Radiation treatments alone would choke a horse. So, for Ed, when he and Alice (his wife of 38 years) became eligible for Medicare, their primary concern was to make sure they were covered so they never had to worry about the bills. What is the best option for us? It turns out that Original Medicare and a Medigap Plan G were right for both of them.

The definition of Insurance is that Insurance is a cost you pay to have someone else assume the risk and payment for you if anything bad happens. Premiums are your commitment to eliminate the chance of catastrophic loss.

We have found that when a couple is married, each partner typically wants the best possible plan and coverage for their spouse, and they are often willing to accept a lesser policy for themselves. However, we have always believed that if couples have the same plan type, it is much easier for them to understand and manage them, especially when they are taking care of one another.

So, ask yourself how much risk tolerance you have, and that should lead you toward one choice or the other. This is how we identify the best Medicare supplement plans for our clients.

WHICH IS THE BEST PLAN FOR YOUR BUDGET?

Living on a fixed income is more complicated than most people think. You are still subject to inflation, like everyone else, but the money you have coming in from Social Security and your investments must last you for the rest of your life. Sometimes this single factor will decide for you.

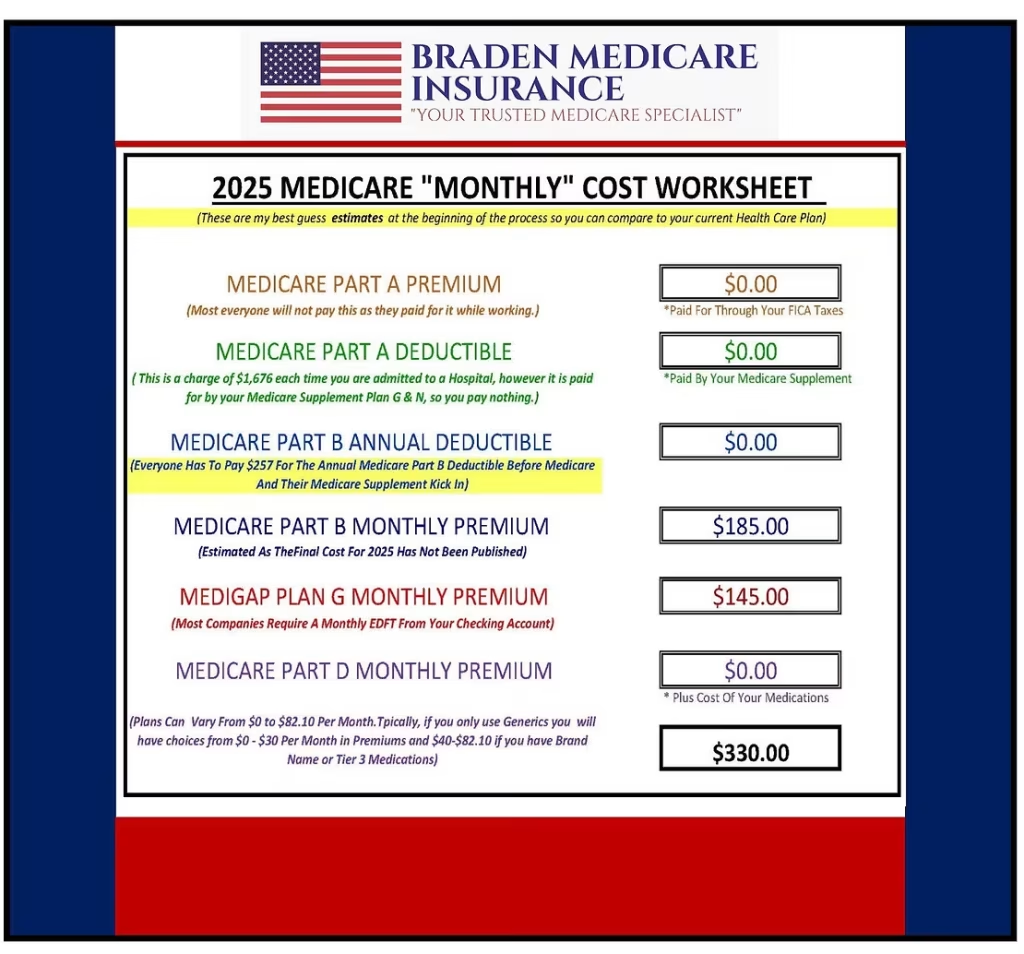

For a person turning 65 and living in Arizona, the monthly cost of a Medicare Supplement Plan G can range from around $145. This amount varies depending on factors such as zip code, gender, age, household discounts, and other considerations. Still, we will use this amount as an example. If your budget includes $1,800 per year for medical insurance, then a Medicare Supplement Plan G provides excellent coverage.

If spending $1800/year leaves you with very little for life’s other expenses, you might be more comfortable with Plan N, or even a High-Deductible Plan G. Remember, you can ask your local, Independent Medicare Broker for help with any of these questions. They will do all the heavy lifting for you, but ethically, they should never make decisions on your behalf. And, if you ever feel a broker is getting too pushy, stop working with them. Pick up the phone, call 2-4 local brokers near you, and conduct interviews with them. You will find one that meets your needs and aligns with your values.

Braden Medicare 2025 Medicare Monthly Cost Breakdown Worksheet

GET THE BEST MEDICARE SUPPLEMENT PLAN FOR YOU, NOT THE BEST PLAN FOR YOUR NEIGHBOR

Too often, people take and accept advice from anyone, including their neighbor, a coworker, someone on Facebook, or Nextdoor, among others. There is nothing wrong with advice, but you have the final say on what you will act on. Everyone is different, with their own unique priorities and goals. There is no one-size-fits-all solution for health insurance.

Your first homework assignment is to examine both Medicare Advantage plans and Medicare Supplement plans and compare their features. Your broker will be happy to explain how you can do that and walk you through the process. Once you have determined whether you are TEAM Medicare or TEAM MEDICARE ADVANTAGE, you can start learning more about all of the plans available in your area. Medicare Supplements are available statewide where you live, but Medicare Advantage plans are typically located only in the county where you live.

.

Lastly, at some point, you may need a Family Member to assist you and look after you and your care. This is typically a Son, Daughter, Niece, or Nephew. We encourage you to invite them into the process of choosing the right Medicare Plan for you. It makes them feel like they are an even bigger part of your lives, and they will always have your best interests at heart, ensuring you always receive the best possible care.

WRAPPING THINGS UP

- All providers that accept Medicare must accept your Medigap plan.

- You can consider the carrier rating, monthly premium, and risk tolerance to help determine the best Supplement plan for your needs.

- Monthly premiums will increase, not necessarily every year, but whenever your partner (the carrier) decides to implement a change, it is usually a cost-of-living adjustment.

- Increases are never based on your individual claims or history. By law, if your insurance partner thinks they need to increase their Plan G premiums, they are obligated to increase the premiums by the same percentage for every Plan G policyholder in your state.

Braden Medicare Insurance Business Card For Michael Braden

If you have any questions or need someone to bounce a few ideas off, please feel free to give us a call. We are always willing to help our friends and neighbors. And remember, we have never charged anyone a penny over the last 10 years for our help, services, or knowledge and expertise.