Getting started in a Medicare Part D Drug plan is generally, easy and straightforward. but, there are instances when signing up for a Part D plan can test the patience of Angels and Saints.

To begin with, you need to ensure that you are 1) Eligible to Enroll and 2) Make sure that you sign up during a valid, enrollment period. For most people, this is during their IEP (Initial Enrollment Period). For others, most will sign -up during the Medicare Annual Enrollment Period or AEP, which takes place each Fall, from October 15th through December 7. The only other time to enroll is during a Special Enrollment Period (SEP).

The last two things to think about is to compare plans available where you live, since not every plan is available in every County/State. You will want to make sure that all of your Medications are available in a plans Formulary, and; that any plan you are considering is a good option for you. You can do this by working with a licensed Independent Medicare Broker in your area or you can use the Medicare Drug Plan Pricing Tool on the Medicare website at www.medicare.gov.

Many people rely on medications, and because Medicare can become overwhelming for people, we have assembled this Article/Guide to help everyone t get enrolled in Medicare Part D.

MEDICARE PART D REVIEW

Medicare is a government-run health insurance program that provides coverage for residents of the United States. Original Medicare comprises Part A and Part B. Part A covers hospital expenses (Inpatient), while Part B covers outpatient care, preventative services, and some medical equipment and supplies.

While Original Medicare does cover a lot, there are some things that it doesn’t—one of those being prescription drugs. That’s where Medicare Part D comes in.

Medicare Part D is a voluntary prescription drug benefit available to all Medicare beneficiaries. Enrollment in Part D is optional, and not everyone needs Part D coverage, as some people may already have prescription drug coverage through their employer, a union, or a private health insurance plan.

But, you need to understand that if you don’t have any other form of prescription drug coverage, and decide not to enroll in Medicare Part D, you will likely pay a late enrollment penalty if you join later on.

You either enroll in a stand-alone Prescription Drug Plan (PDP) or a Medicare Advantage Plan (MAPD) that includes Medicare drug coverage.

STAND-ALONE MEDICARE PRESCRIPTION DRUG PLAN (PDP)

A PDP is a type of Medicare drug plan that is offered by private insurance companies approved to sell drug coverage. These plans are regulated by Medicare and mandated to meet certain minimum requirements. This is the most common type of Medicare drug plan to supplement Original Medicare. To be eligible for a PDP, you must be enrolled in Medicare Part A.

A PDP will cover some or all of the costs of your prescription drugs and has a monthly premium.

Not all Medicare Prescription Drug Plans are the same—each plan has its own list of covered drugs (called a formulary), which may change from year to year. Some plans may place certain drugs on a tier that requires you to pay a higher coinsurance or co-payment. As you shop for a Part D Plan. compare Part D plans

MEDICARE ADVANTAGE PLAN THAT INCLUDES PRESCRIPTION DRUG COVERAGE(MAPD)

The second option is a Medicare Advantage Plan, in this case, one that includes drug coverage. Medicare Advantage Plans are provided by private insurance companies and must be Medicare-approved. To be eligible for a MAPD (Medicare Advantage Prescription Drug Plan), the person should have both Part A and B.

MAPDs offer Original Medicare coverage and oftentimes more. Medicare Advantage coverage can include prescription drugs, dental care, vision care, and, depending on the plan, even gym memberships. Like PDPs, each MAPD has its own formulary of covered drugs that may change yearly.

WHO CAN GET A MEDICARE DRUG PLAN?

To qualify for Part D coverage, you must first be enrolled in Medicare. So really, the question should be, who is eligible for Medicare?

- US residents ( living in the USA for at least five continuous years) who are age 65 or older

- US residents under the age of 65 but have a qualifying disability

- Any age with End-Stage Renal Disease (ESRD)

United States citizens currently residing outside the country are not eligible but can apply for Medicare upon returning to the States.

WILL EACH OF MY MEDICATIONS BE COVERED?

Part D provides coverage for both brand-name and generic drugs. Your Medications and the amount you pay for your prescriptions depend on which plan you choose.

To be eligible for coverage, drugs must be FDA-approved and used for a medically necessary purpose. For instance, weight loss or cosmetic drugs are not covered. However, drugs to help with the cessation of smoking are.

Medicare Part D plans are required to include a minimum of two drugs from 148 categories. Plus covers substantially all drugs from six protected categories.

Protected Categories include:

- Antidepressants

- Antipsychotics

- Anticonvulsants

- Antiretrovirals

- Antineoplastics

- Immuno-Suppressant drugs

The formulary – the list of drugs covered by the Medicare drug plan will differ between private insurers. Therefore, choosing a drug plan with a formulary compatible with your requirements is important.

Though the United States government regulates Medicare Part D plans, they are not standardized. Each plan is different regarding the prescription medications covered and the cost to the consumer. However, all Medicare drug plans must meet a certain level of minimum benefit.

Formularies are also tiered. The patient’s share of the bill will differ based on which tier their medication is in. Private companies can determine their own number of tiers, but most are broken down into five categories:

- Tier 1 Generic drugs – These often have no copay, which means no cost to the consumer.

- Tier 2 Generic drugs and some common brand names – These may require a small copay and often no copay.

- Tier 3 Brand name and preferred drugs – Typically, they will have a higher copay. More recently, some insurance companies have made tier 3 a coinsurance tier with the consumer paying 25% of the price. The result is higher out-of-pocket costs for the consumer.

- Tier 4 & 5 Specialty drugs – The consumer will be responsible for a percentage of the cost as co-insurance.

It’s important to note that a drug plan’s formulary can change each calendar year.

CAN I SIGN UP ANYTIME FOR A PART D PLAN?

You have two primary windows of opportunity to sign up for Medicare Part D. The first is your Initial Enrollment Period (IEP), and the second is during the Annual Election Period (AEP). Under certain circumstances, you may also qualify for a Special Enrollment Period (SEP).

Of course, if you currently have Medicare and move to another state or outside the local service area of your current plan, you will have a Special Enrollment Period (SEP) to get a new plan. If you change addresses and move out of your current plan's coverage area, you have 63 days from your move date to get a new Part D plan.

DO I HAVE TO SIGN UP EVEN IF I DO NOT TAKE ANY PRESCRIPTION MEDICATIONS?

No, Medicare Part D is optional. But..............if you choose to enroll at a later time, you will have a penalty added to your monthly Part D Plan premium. That penalty is only about .37 cents for each month you had no Medicare Drug coverage, however, the penalty is not a one-time penalty. The additional amount will be added to your Part D premium forever.

IEP (INITIAL ENROLLMENT PERIOD)

The Initial Enrollment Period is the time when you first become eligible for Medicare. For most people, this means age 65. If you already receive Social Security or Railroad Retirement benefits, you’ll automatically be enrolled in Original Medicare Part A and Part B when you turn 65.

If you are not receiving Social Security benefits, you’ll need to sign up for Medicare through the Social Security Administration.

You can also enroll in Medicare Advantage and prescription drug coverage during the IEP.

The Initial Enrollment Period lasts for seven months – three months before the month you turn 65, the month you turn 65, and three months after the month you turn 65. You can use our handy Medicare Initial Enrollment Period Calculator Here.

The IEP is an important time to sign up for Medicare, so enroll as soon as you become eligible.

THE ANNUAL ENROLLMENT PERIOD (AEP)

If you didn’t enroll during your Initial Enrollment Period and later decide you want Part D coverage, you can sign up during the Medicare Annual Election Period (AEP) from October 15 to December 7. Then your coverage will begin on January 1 of the following year.

As well as adding drug coverage, during AEP, you can also:

- Join, switch, or drop a Medicare Advantage Plan

- Switch from an Original Medicare to a Medicare Advantage Plan or back

- Sign up for Part A and/or Part B if you don’t already have them

GENERAL MEDICARE ENROLLMENT PERIOD (GEP) AKA: MEDICARE ADVANTAGE OPEN ENROLLMENT PERIOD

Another opportunity to sign up for Medicare Part B if you missed your IEP is during the General Enrollment Period (GEP). The GEP is in effect from January 1 to March 31 each year. At this time, you can also add stand-alone drug coverage or a MAPD plan when you enroll in Medigap Part B.

SPECIAL ENROLLMENT PERIOD (SEP)

You can also sign up for Medicare Part D during your Initial Enrollment Period. However, if you didn’t enroll in Part D when you were first eligible, there are times when you can still sign up. These are called Special Enrollment Periods (SEPs) and the Annual Election Period (AEP).

Qualifying reasons for a Special Enrollment Period might include:

- RELOCATION – If you are moving out of your current plan's service area, you may be able to join a new plan.

- LOSING EMPLOYER COVERAGE OR OTHER CREDITABLE PRESCRIPTION DRUG COVERAGE – You may qualify for a SEP if your prescription drug coverage through an employer or union is lost or no longer creditable.

- COMING BACK TO THE US FROM LIVING OVERSEAS – You have two months from the date you move back to the States to sign up for Part D.

- MOVING INTO OR OUT OF A SKILLED NURSING FACILITY – If you move into or out of a skilled nursing facility (SNF) or long-term care facility, you can join, switch, or drop your Part D plan.

IS THERE A PENALTY IF SOMEONE DOES NOT ENROLL IN A MEDICARE PART D PLAN ON TIME?

As previously stated, the ideal time to enroll in Medicare Part D is when you first become eligible. If you don’t enroll in Part D during the IEP and later decide you want coverage, you may have to pay a late enrollment penalty.

The amount of the premium penalty is 1% of the national base beneficiary premium multiplied by the number of full, uncovered months that you were eligible for Part D but didn’t enroll. You will also have to pay this penalty if you go more than 63 days in a row without creditable prescription drug coverage after your initial enrollment period.

At first glance, it might seem like a few dollars isn’t much to worry about. However, the late enrollment penalty is calculated based on the average monthly premium for a basic Part D plan and is applied for as long as you have Part D coverage.

It’s important to note that you may have to pay a late enrollment penalty even if you had other drug coverage, such as through an employer. This is because not all drug coverage is considered creditable.

Creditable prescription drug coverage is coverage deemed to be at least as good as the standard Medicare Part D prescription drug benefit.

If you have creditable prescription drug coverage when you’re first eligible for Medicare, you can choose to delay enrolling in Part D without worrying about a late enrollment penalty. However, you’ll need to provide proof of your creditable coverage if you do enroll in Part D.

STEPS ON GETTING PROPERLY ENROLLED IN MEDICARE PART D

The first step is to compare plans and find one that meets your needs. Once you’ve selected one, the next step is to enroll. Most Part D plans will allow you to enroll online via their website, phone, mail, or even in person.

ARE PART D PLANS FREE?

No, there is a WellCare Value, Script Stand-Alone PDP plan that has had no monthly premium for the past 2 years in Arizona and Nevada. But, since plans change annually, it is always wise to look into finding the best plan for you each year during the AEP.Part D prescription drug coverage costs vary depending on your chosen plan and the required medications. All plans, however, have a monthly premium that you must pay.

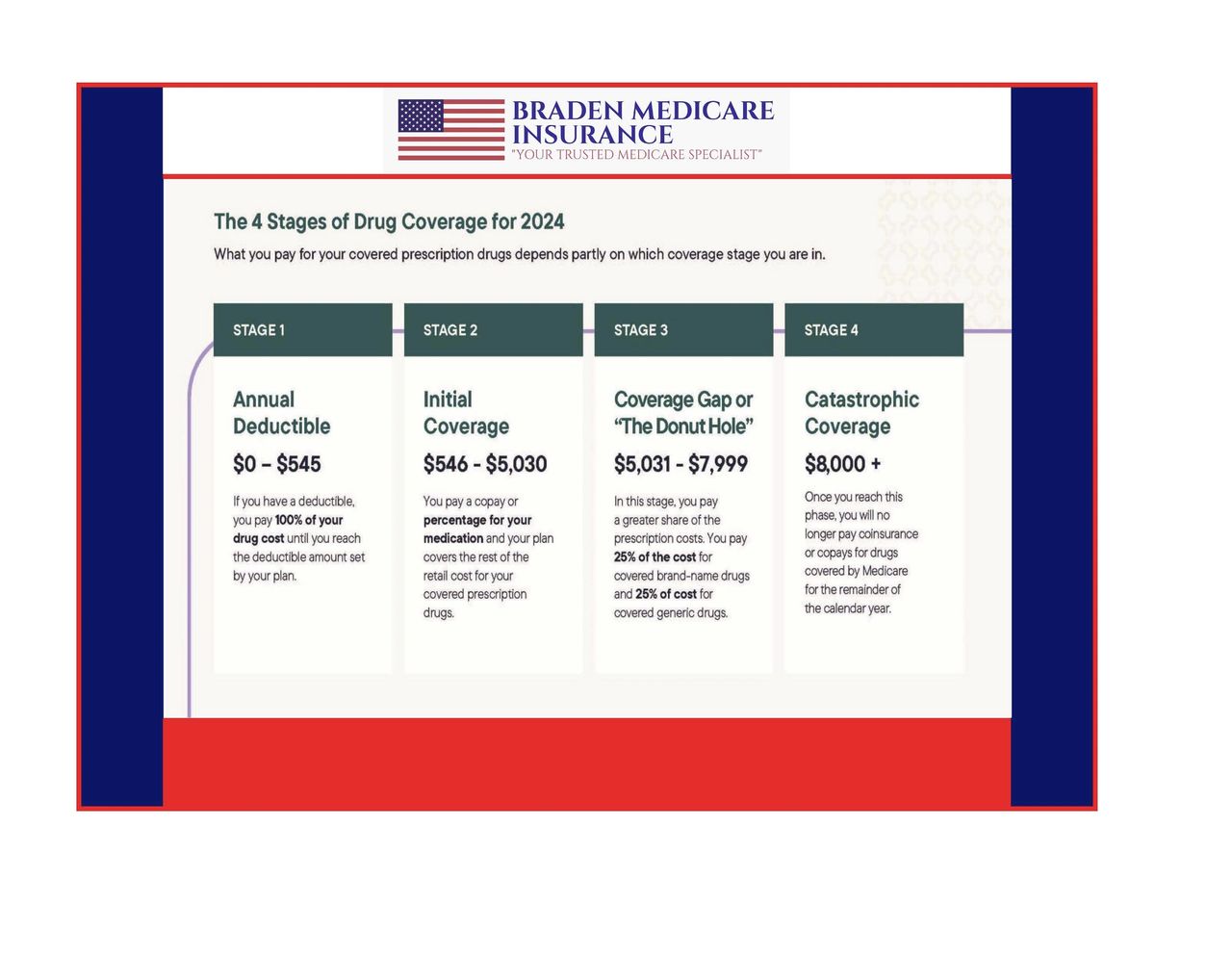

STAGES FOR 2024 MEDICARE PART D DRUG PLANS

DOES MEDICARE PART D WORK WITH OTHER INSURANCE?

You may not need to enroll in a Part D plan if you have creditable prescription drug coverage. Creditable means that the other insurance is expected to pay at least as much as Medicare’s standard prescription drug coverage.

Coverage from one of the following government-sponsored insurances is worthwhile sticking with.

- Civilian Health and Medical Program of the Department of Veterans Affairs

- Federal Employees Health Benefits Program

- TRICARE

- Indian Health Services

WRAPPING THINGS UP

As you can see, there are several things you should consider before signing up for Part D Medicare. Hopefully, the information we’ve provided has been easy to understand as well as being useful for you.

You can learn more about Medicare Part D by visiting our website at www.bradenmedicare.com, or simply give us a call, and we will be happy to answer all of your Medicare Part D questions.

There are times when getting enrolled in a Medicare Part D Prescription Drug plan is tricky, if you need help, contact us and we will be happy to assist you.

%20Poste.jpg/:/cr=t:0%25,l:0%25,w:100%25,h:100%25/rs=w:1280)