Everyone who is approaching Age 65 and some of you who have decided to continue working past age 65, eventually have to begin understanding and dissecting the elephant in the room known as Medicare. I know firsthand how confusing Medicare can seem to people, but it is not anything to get too worked up over. In the long run, Medicare is a fairly simple program, provided you have a good teacher to explain the ins and outs to you, which is exactly what I hope to do in sharing this article with you.

So when you have about 30 minutes to spend, please either print this article or take your laptop or tablet to your favorite reading spot, enjoy your beverage, and make notes as you read through this Medicare Made Easy Guide. When you are done, please feel free to call or email us at Braden Medicare to answer your questions or let us help guide you in any way we can. Simply put, we are here to help others and make some new friends by sharing some expert information that you cannot get from your neighbor, your Sisters best friend, or from the guy who knows from Facebook.

PREVIEWING THIS ARTICLE

- It’s helpful to start with the basics when understanding Medicare, including eligibility, when and how to enroll, and the different parts of the program: Part A, B, C, and D.

- When you have a good grasp of the framework of Medicare, you can start to learn about the costs associated with each Medicare Option you will have to choose from, along with what Medicare DOES and DOES NOT cover.

- Everyone who enrolls in Medicare has three choices for their Healthcare, They are:

OPTION #1

Medicare in its purest form is what is known as Original Medicare. Original Medicare comprises Medicare Part A (In-Patient & hospitalization costs and Services) and Medicare Part B (all of your Outpatient costs and services such as doctors, Office Visits, Labs, Diagnostics, Screenings, Procedures, and Durable Medical Equipment).

Original Medicare is a straightforward 80/20 Plan where Medicare pays 80% of all Medicare-approved (Medically Necessary) procedures and you are responsible for your 20%. There is no Deductible (Aside from the annual $226.00 Part B Deductible), No Minimums, and no Maximums. Plus, there is a $1,632 Part A Deductible if you’re admitted into a hospital (Each 60 days). With Original Medicare you can see any Doctor and use any Physician anywhere in the United States because there are no networks. (Only about 1% Of People Choose This Option)

OPTION #2

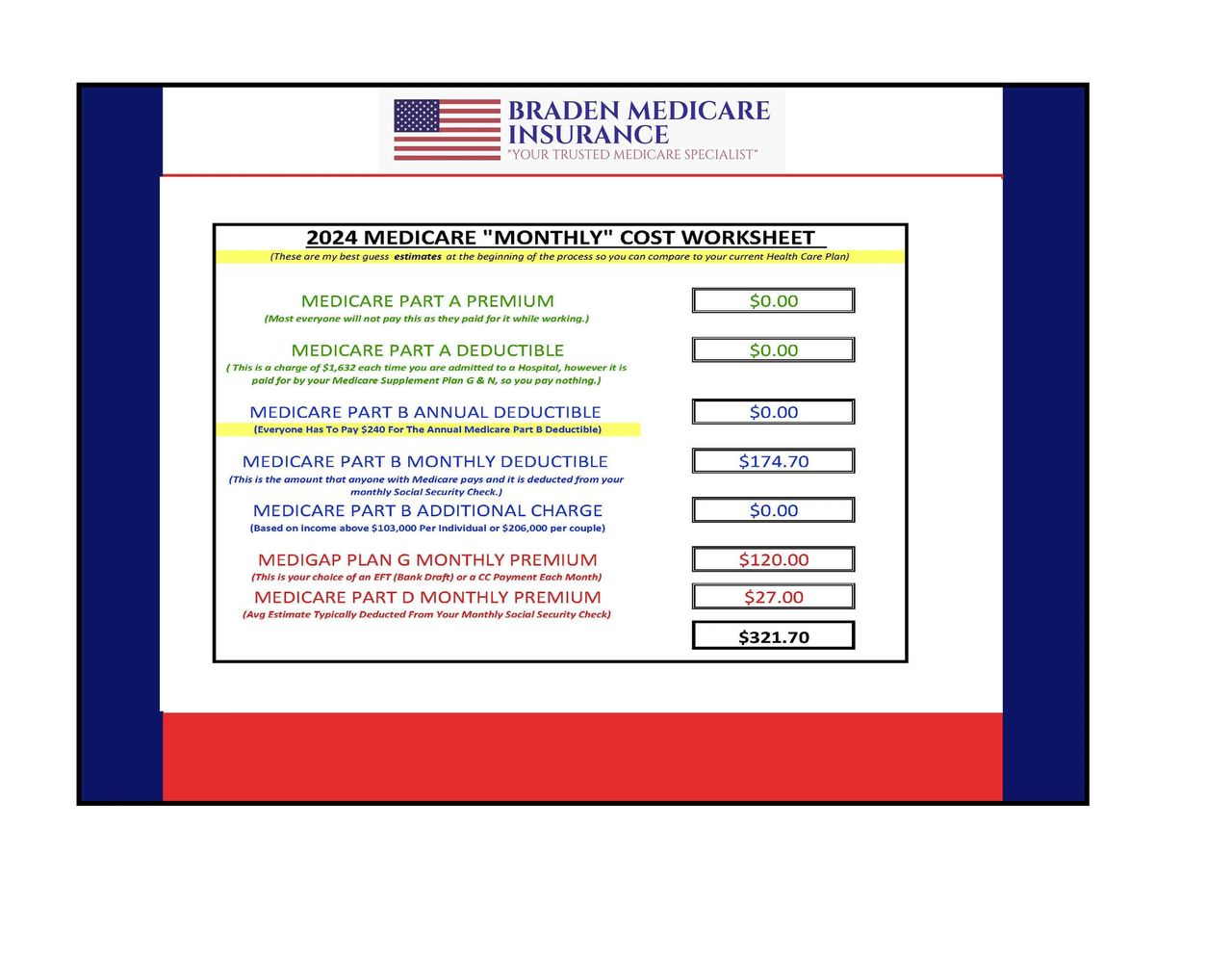

Original Medicare with a Medicare Supplement or Medigap plan. A Medicare Supplement can pay for all of your 20% share of all of your Healthcare, depending on which Medicare Supplement Plan you choose. Plan G is the most popular and has the best Value. It runs between $120-$150 per month. This is still an 80/20 plan, but aside from your premium, you would only have to pay the Annual Part B Deductible of $226.00 out of pocket, everything else, including the Part A Deductible, will be paid by Medicare, and your Medicare Supplement plan.

Altogether the best estimate for the best coverage with no hidden costs would be around $320 per month and include absolutely everything, with no deductibles (aside from the $240 Annual Part B Deductible), no co-pays, no co-insurance, no additional deductibles to meet. And you can see any doctor or receive services at any hospital in the United States. With a Medicare Supplement Plan G, your maximum Annual Out-Of-Pocket Expense will be your Medicare Supplement /Medigap plan premium and the Annual Part B Deductible of $240. About 6 out of 10 people choose this plan.

OPTION #3

A Medicare Advantage, often referred to as Medicare Part C. These are plans offered by a private for-profit Medicare Insurance company. These companies receive money from Medicare, and these companies manage their plans. You will either choose an HMO (Health Maintenance Organization) or a PPO (Preferred Provider Organization) Plan. An HMO plan typically will include a Part D Prescription Drug Plan, but you will have to see their network of doctors and hospitals. This means you have little or no coverage outside of the city or out of the state.

A Medicare Advantage PPO plan will have more options for doctors who are outside of the plan's network. However, most Medicare Advantage PPO plans do not include any Part D. The majority of MA (Medicare Advantage) HMO plans have a $0 premium. A MA/PPO plan will range from $0 to $100 depending on where you live. With every Medicare Advantage Plan, you pay your 20% throughout the year. There is an annual maximum that varies by plan, they range from $2,800 - $5,900 annually in network and up to $12,000 a year if you go out of network. Once you meet the MOOP (Maximum Out-Of-Pocket) amounts for a given year, your plan pays 100% of the charges for the remainder of that Calendar year.

This means that if you run into bad luck, you could pay out of pocket up to the amount of your maximum out-of-pocket expense every year (MOOP). About 4 in 10 Choose Medicare Advantage.

Everyone who chooses Medicare Advantage must pick a new plan each year during the Medicare Annual Enrollment Period. They can keep their current plan if it is still available, or they can choose a new plan that will start on January 1st.

Medicare Advantage plans are often referred to as Medicare Part C. These are plans offered by a private for-profit Medicare Insurance company. These companies receive money from Medicare, and these companies manage their plans. You will either choose an HMO (Health Maintenance Organization) or a PPO (Preferred Provider Organization) Plan. An HMO plan typically will include a Part D Prescription Drug Plan, but you will have to see their network of doctors and hospitals. This means you have little or no coverage outside of the city or out of the state.

A Medicare Advantage PPO plan will have more options for doctors who are outside of the plan's network. However, most Medicare Advantage PPO plans do not include any Part D. The majority of MA (Medicare Advantage) HMO plans have a $0 premium. A MA/PPO plan will range from $0 to $100 depending on where you live. With every Medicare Advantage Plan, you pay your 20% throughout the year. There is an annual maximum that varies by plan, they range from $2,800 - $5,900 annually in network and up to $12,000 a year if you go out of network. Once you meet the MOOP (Maximum Out-Of-Pocket) amounts for a given year, your plan pays 100% of the charges for the remainder of that Calendar year.

This means that if you run into bad luck, you could pay out of pocket up to the amount of your Maximum out-of-pocket expense every year. About 4 in 10 Choose Medicare Advantage.

Everyone who chooses Medicare Advantage must pick a new plan each year during the Medicare Annual Enrollment Period. They can keep their current plan if it is still available, or they can choose a new plan that will start on January 1st.

KATIE BAR THE DOOR AND THE MAILBOX TOO

Once you turn 64, your name and address are made available to every Insurance company in America that offers any sort of Medicare Insurance. You can contact the SSA Office and ask them to please remove your name from the lists they send to Medicare Insurance carriers.

Understanding Medicare is easier said than done. You get a big ‘old Medicare & You Handbook for 2024 in the mail, full of terms you’ve never heard before. Then there are scores of insurance companies filling your mailbox to the brim every week with an assortment of Flyers, Brochures, Pamphlets, and Postcards.

A few ideas to help you through this transition:

- Make Up An Email Account Just To Receive Medicare information. Maybe Something Like JimmyTurns65@gmail.com. Use this strictly for anyone looking to send you information and keep your regular email private.

- DO NOT GIVE YOUR PHONE NUMBER to anyone, or write on any Postcards asking if you would like to receive more information on Medicare. These are lead cards that are sent to agents, and they will drive you nuts.

- You can save anything that comes from the Social Security Administration or from CMS (Medicare). Everything else you can throw away. Start researching local, independent Medicare Brokers in your area, or call us. We can assist you with teaching you to how to interview prospective Brokers so you can find an expert who will help you through the Medicare process, and be available to you in years to come. Brokers are free, they never charge a fee, and they can do all of the HEAVY LIFTING for you.

EVERYONE WHO ALREADY HAS MEDICARE HAS HAD TO DEAL WITH EVERYTHING YOU ARE NOW

If you feel overwhelmed, confused, lost, or out feel like you have been put into a Foreign Country, you are not alone. Everyone new to Medicare feels this in some way or another. Just accept it, and do not stress over it. This post will help you cut through the fluff. Work through these 4 steps in order so that you learn the basics first.

THE BASICS OF MEDICARE

Medicare is the United States National Insurance Plan for Americans 65 and over and for people under 65 who have been designated Disability Status by the Social Security Administration. A very important distinction that many people get wrong is they think Medicare is only for Poor people who cannot pay for insurance on their own. That is incorrect. Medicare is the National Health Insurance program. Medicaid is for people with limited incomes and/or those who may need extra help paying for their health insurance, medications, etc.

Who can get Medicare? Anyone who is 65 in America, even permanent residents who have lived here for at least 5 years. For people approaching age 65, it doesn’t matter if you are taking Social Security benefits yet.

You actually apply for Medicare through the Social Security Office. Then, once they have verified your information, they will transfer your information to Medicare. You do not have to start taking your Social Security Benefits at age 65. You can start doing that as soon as age 62, and, you can decide to wait until you are 70 if that is your preference. But, once you begin taking Social Security, you will be automatically enrolled in Medicare Part A and Medicare Part B when you turn 65.

MEDICARE HAS 4 PARTS

MEDICARE PART A

Part A is your Hospital Coverage. This coverage pays for your room and board in the hospital or in a skilled nursing facility. In-Patient Care = Medicare Part A!

MEDICARE PART B

Part B is your Outpatient Coverage. This includes doctor visits, medical equipment, lab work, X-rays, MRI's, Preventative Screenings, Out-Patient Surgical procedures, etc.

MEDICARE PART C

Medicare Part C refers to Medicare Advantage Plans. If you choose to receive your Healthcare Benefits from a Medicare Advantage Plan, you will be participating in Medicare Part C.

For those with Original Medicare, you will never have Medicare Part C. When President Clinton signed Medicare Part C into law, it was originally referred to as Medicare Choice (hence Choice = Part C)

MEDICARE PART D

Part D is coverage for your prescription medications. Medicare Part D is available in two forms. The first is as a Stand-Alone Prescription Drug Plan for those with Original Medicare. You will pay a monthly premium in exchange for a lower price for your prescription medications. However, if you choose a Medicare Part C plan (aka Medicare Advantage) the majority of MA plans are what are known as MAPD plans, meaning that Prescription Drug coverage is already included and bundled together with your healthcare coverage.

COSTS ASSOCIATED WITH THE 4 PARTS OF MEDICARE

Alright, so we know you are eligible for the 3 parts of Medicare at age 65. Now you’ll need to know what you can expect to pay for each of these parts. This is especially important if you are deciding whether to stay working past age 65 for an employer who offers health benefits or whether you will retire and go onto Medicare as your primary insurance.

MEDICARE PART A COSTS

Medicare Part A is free for 98% of Americans. This is the part of Medicare we paid into through Payroll deductions during our working careers. Most people qualify, as long as they or a spouse have worked for at least 10 years in the United States.

MEDICARE PART B COSTS

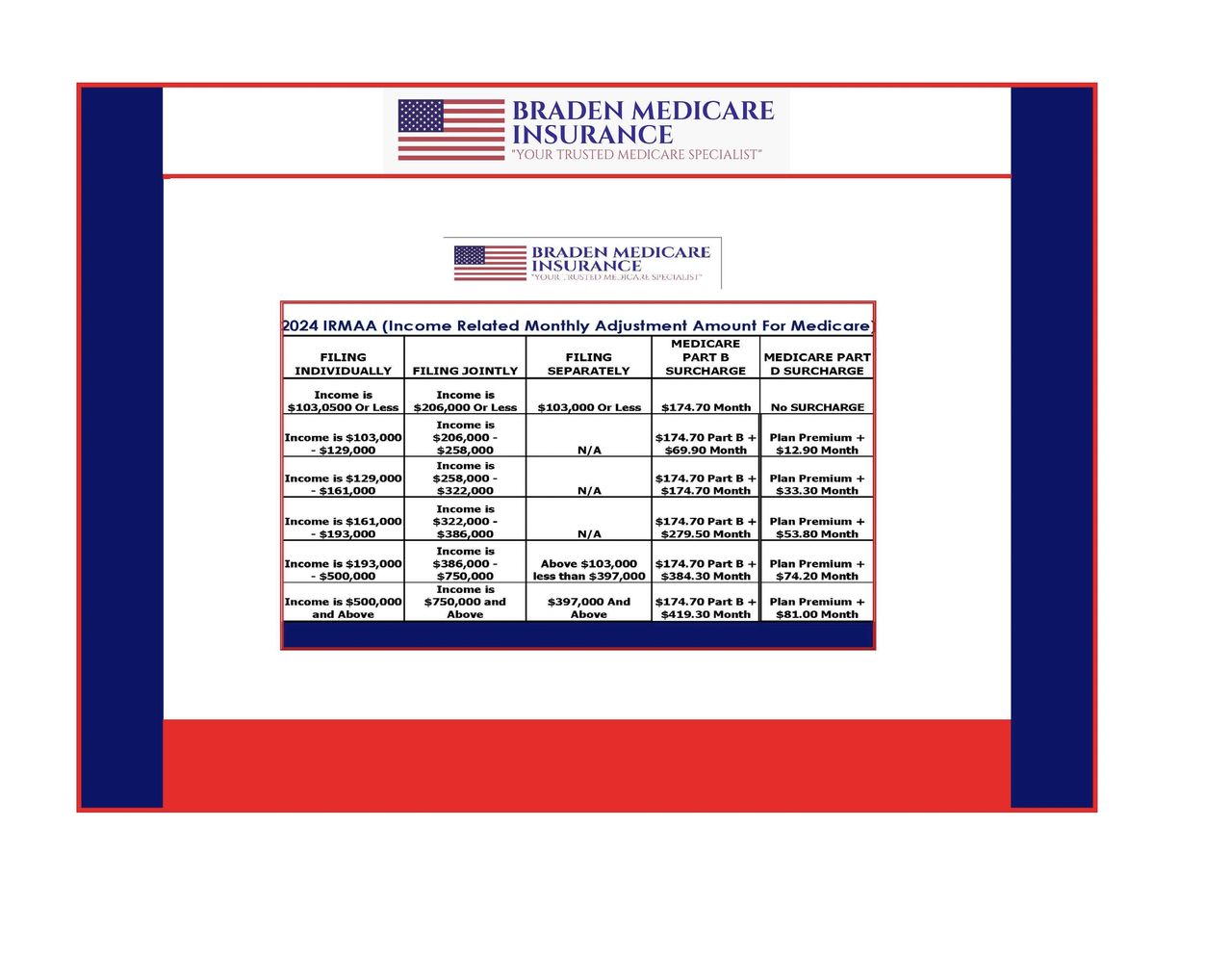

Medicare Part B depends on your income because Medicare does add a surcharge if you will for high-wage earners. This is called IRMAA and IRMAA stands for Income Related Monthly Adjustment Amount.

Everyone who participates in Medicare, whether it is with Original Medicare, Original Medicare with a Medicare Supplement or Medigap plan, or; if you choose Medicare Part C (Medicare Advantage) will pay a minimum of $174.70.

Social Security bases your income adjustment on your income as reported on your tax returns. They are usually looking at your income tax return from two years prior to now.

If your income has decreased since then, you can file a reconsideration request. You’ll present proof of your lower income and ask Social Security to lower your Part B premium. They will reconsider your premium and notify you if it can be lowered.

Once Social Security has determined what you’ll pay based on your income, they will deduct your Part B premiums from your monthly income benefits. If you have delayed enrollment into your Social Security income benefits, then they will invoice you for Part B on a quarterly basis.

Later on, when you file to start your income benefits, they’ll switch over to the monthly deduction from your SS check.

EVERYONE MUST ENROLL IN MEDICARE PART B

Medicare Part B is an absolute must if Medicare will be your primary insurance at age 65. In fact, you can’t buy any supplemental insurance unless you first have both A & B.

However, if you actively work for a large employer (20+ employees), that will continue to be your primary insurance. Medicare will be secondary, so you can consider delaying Part B since your group insurance probably includes outpatient benefits already.

click here.)

MEDICARE PART C COSTS AKA MEDICARE ADVANTAGE COSTS

The majority of Medicare Advantage HMO Plans have a $0 Premium. But, many other Medicare Advantage plans can have premiums ranging from $10 - over $100 per month, depending on where you live. for example, a Medicare Advantage HMO in New York State can cost $165 per month and in Arizona, a Medicare Advantage PPO plan with a Prescription Drug plan included, is $0.

MEDICARE PART D COSTS

Understanding Medicare Part D costs is a bit tricky because plans have varying premiums. Beneficiaries also might pay more due to their income, just as mentioned above in the Part B costs section.

Most states have more than 20 different Part D plans to choose from. In fact, the national average Part D premium is currently around $35 per month. That’s fair ballpark figure to use if you are just running some estimates today.

Part D plans have different drug formularies, so you’ll choose one that offers your medications at decent prices. The Medicare website has a great, user-friendly plan finder tool to help you choose one that fits you.

Part D premiums get paid directly to the insurance carrier. However, you can request that Social Security deduct that monthly premium from your monthly Social Security Disbursement check. If you owe an income adjustment for having a high income, this surcharge will be added to the monthly premium of your chosen Part D drug plan.

WHAT DOES MEDICARE COVER AND WHAT DOES MEDICARE NOT COVER?

By this time, you are wondering: exactly what am I paying for? What are my benefits?

Medicare covers most of your healthcare costs, but you are still responsible for your share. This includes things like deductibles, coinsurance, and co-pays.

It’s quite similar to employer coverage you’ve had in the past. You paid your share of the monthly premium via paycheck deductions. That purchased the insurance coverage. Then when you used that insurance, you also paid your share of each medical service, right? You had co-pays at the doctor’s office. You probably also incurred a deductible if you had surgery or a hospital stay. It works the same with Medicare.

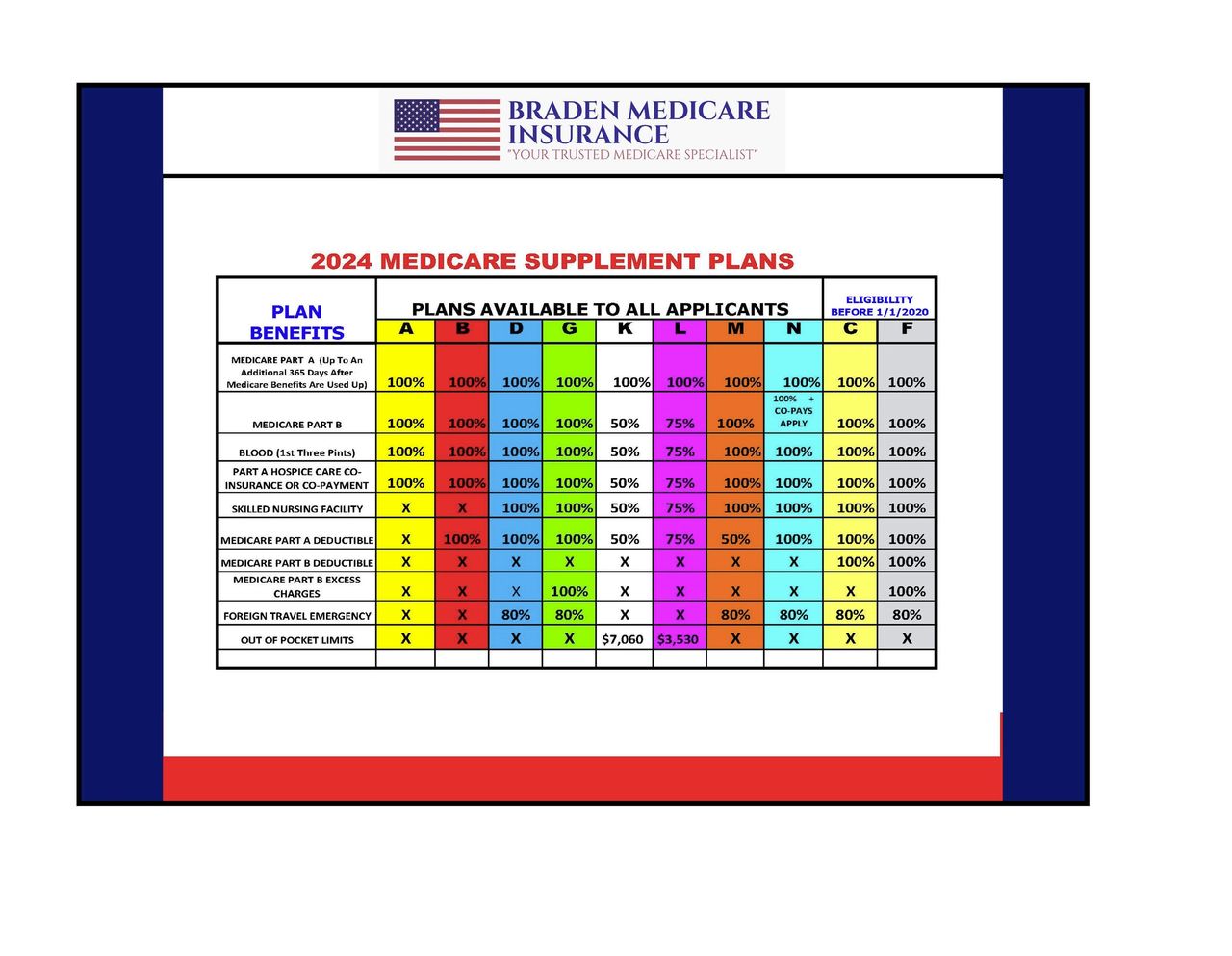

MEDICARE SUPPLEMENT PLANS & MEDIGAP PLANS

Medicare Supplement or Medigap plans pay for things that are normally your share. For example, all Medigap plans cover the 20% that talked about earlier in this article. Medicare will pay 80%, for all of your covered expenses with Original Medicare and your Medigap plan will then pay the other 20% of your Part B outpatient expenses. Some Medigap plans also cover your Part A and B deductibles. You can choose your own Part D drug plan to go alongside this coverage.

Medigap plans also allow you freedom of choice in your medical care. You can see any physician or healthcare provider that participates in Medicare (nearly 900,000 providers across the nation). These plans cost more than Advantage plans because they are more comprehensive. They also give you more freedom in choosing your providers.

MEDICARE ADVANTAGE PLANS &MEDICARE PART C ARE THE SAME THING

Understanding Medicare Advantage plans can be a bit confusing because the Medicare Advantage program is also called Part C of Medicare.

Medicare Advantage Plans, are Healthcare plans that are offered by Private Medicare Insurance companies, not Medicare. These plans are optional, and they were created to give a low-cost alternative to Medigap.

Advantage plans are private insurance plans with their own local network of providers, generally an HMO or PPO style plan. When you join an Advantage plan, you’ll see these providers in order to get the lowest co-pays.

You will pay co-pays for doctor visits, hospital stays, and any other Medicare-approved services. Medicare Advantage plans generally have lower premiums than Medigap plans. That’s because you agree to share in the costs by paying co-pays for services as you obtain them. (Whereas with a Medigap plan, you often will have NO co-pay, depending on the plan you choose.)

Most Medicare Advantage plans also include a rolled-in Part D drug benefit. Depending on whether that rolled-in benefit includes the specific medications you need, this can be a benefit or a hindrance. Each type of plan has its advantages and disadvantages.

You’ll want to be thinking about what things are most important to you. For example, do you travel? Is there a past Health History of Cancer? Will your plan cover your preferred Hospitals? Are all of your Doctors and Medications available with your plan?

BEST ADVICE FOR DEALING WITH ALL OF THE FLYERS, POSTCARDS, AND BROCHURES THAT ARE FILLING YOUR MAILBOX EVERY WEEK

KEEP ALL MAIL FROM THE SOCIAL SECURITY ADMINISTRATION AND FROM CMS (CENTERS FOR MEDICARE AND MEDICAID SERVICES.

Once you have decided what type of plan you want, you can throw away everything else. So, if you decide that Original Medicare with a Medicare Supplement fits your needs the best, then throw away anything having to do with a Medicare Advantage Plan (Medicare Part C).

I would advice everyone to also pitch all of the mailers you get about Medicare Part D plans in the garbage. Why, here is why, because you never want to choose your Part D plan based on an advertisement. You want your agent to help you run an analysis using Medicare’s Prescription Drug Finder tool. There’s no better tool to help you identify the most comprehensive drug plan for you. (If your agent doesn’t help with Part D, toss out the agent wile you are tossing out all of the other useless drivel!

IN CONCLUSION............

So do you feel like you know a lot more about Medicare now than you did thirty minutes ago?

While there is no truly simple explanation of Medicare, I really do hope we’ve helped you get the basics down. There’s no need for you to do this alone. Get someone on your side when it comes to understanding Medicare today! There’s absolutely no cost to you for our help.You can call, text or email us anytime if you have questions or just just want to chat.