You may find yourself asking, what is Medicare? Medicare is the National Health Insurance Program for Americans aged 65 and over or those who meet particular eligibility criteria.

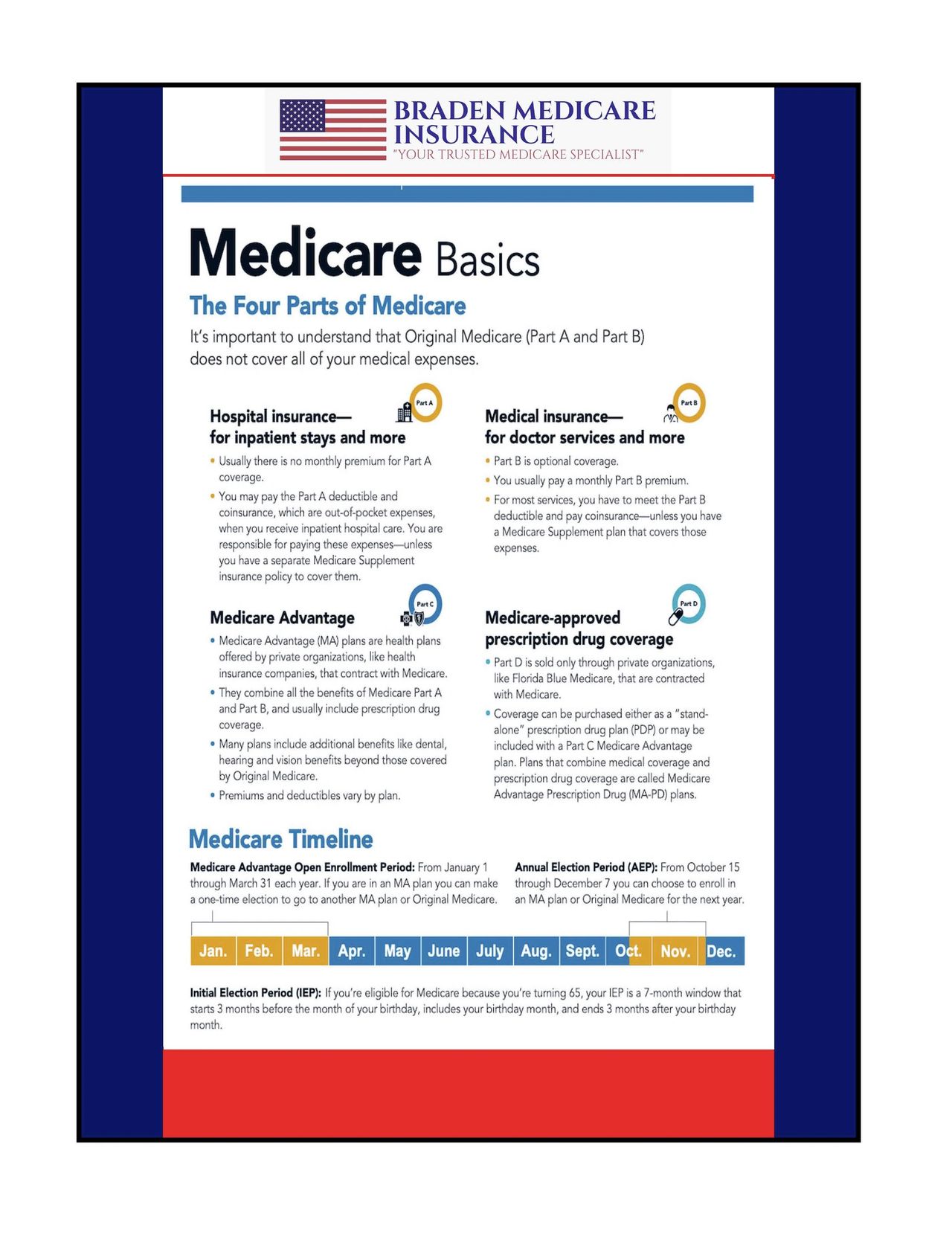

Medicare consists of four parts. However, additional options are available for those who want a higher level of coverage.

Medicare can be confusing if you are not adequately educated. That is where we come in. Below, we review the four parts of Medicare and how they work together to provide healthcare coverage.

DEFINING MEDICARE

Medicare is defined as federal health insurance for people 65 or older, those younger than 65 with disabilities, and those with ALS, or end-stage renal disease.

Original Medicare, Part A, and Part B make up Original Medicare. These parts are inpatient hospital coverage and medical coverage, respectively. Medicare Part C and Medicare Part D provide benefits to help Medicare resemble group or employer coverage. Medicare Part C can include dental or vision coverage, while Medicare Part D is prescription drug coverage.

Medicare is the most widely used healthcare coverage for those over 65. So, if you are nearing eligibility, it is essential to understand what Medicare is and how the four parts work.

However, Medicare does not cover everything. Often, you may need to enroll in additional plans to receive full coverage.

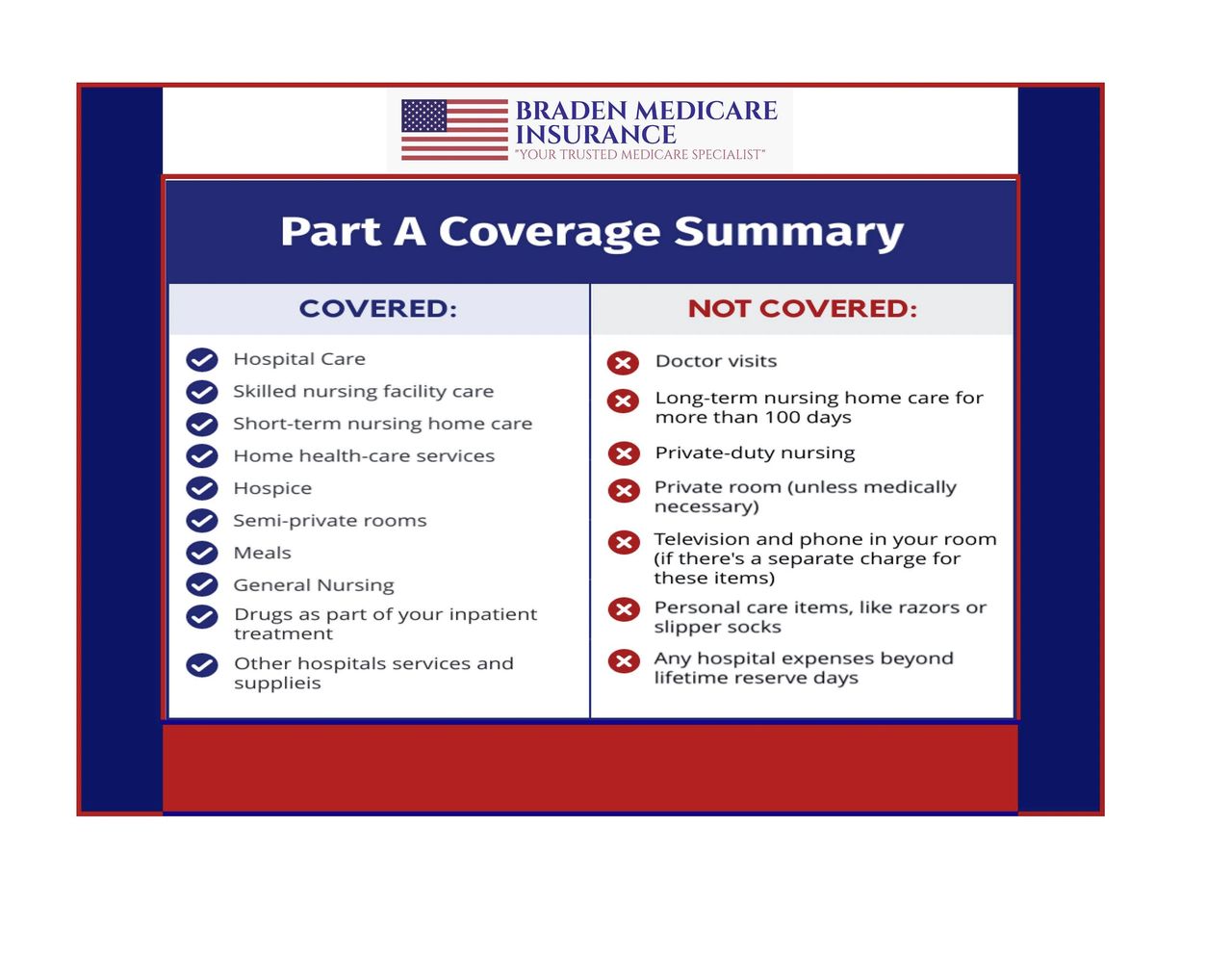

MEDICARE PART A

Medicare Part A is inpatient hospital insurance. This part of Medicare covers some of your hospital, inpatient nursing facility, and hospice costs.

Remember that Medicare Part A does not cover any of the treatments or procedures you receive while in a hospital or skilled nursing facility. This part of Medicare only covers the cost of the facility itself.

When you enroll in Medicare Part A, you are responsible for paying a per-occurrence deductible and daily co-pays after meeting the deductible.

For most, Medicare Part A has a $0 monthly premium. You qualify for a zero-premium if you have worked at least ten years paying Medicare tax in the United States. Otherwise, you must pay a monthly premium. This premium can be as high as $505 per month in 2024.

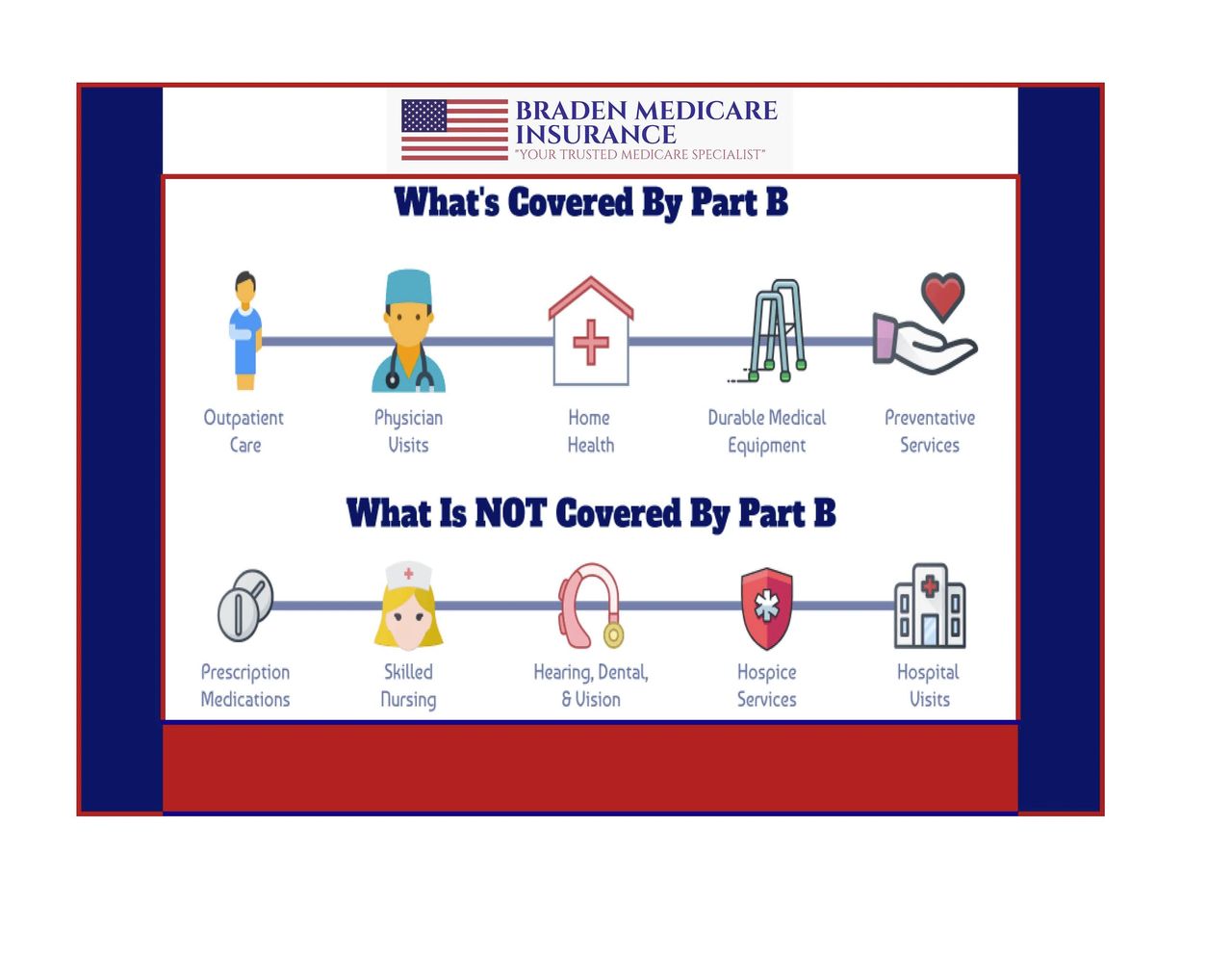

MEDICARE PART B

Medicare Part B is medical insurance. This part of Medicare covers your doctors’ visits, procedures, and treatment while you are in the hospital.

Part B of Medicare covers both preventive and medically necessary services. Additionally, Medicare Part B covers durable medical equipment you may need to manage health conditions.

Medicare Part B requires you to meet an annual deductible before you receive coverage. Once you meet your deductible, Medicare Part B will cover 80% of your cost, and you are responsible for the remaining 20%. There is no maximum out-of-pocket amount for Medicare Part B, therefore there is no cap on your costs.

Unlike Medicare Part A, you must pay your Medicare Part B premium, regardless of how long you paid Medicare taxes while working. The standard monthly Medicare Part B premium is $174.70 in 2024. However, this may be higher, depending on your monthly adjusted gross income.

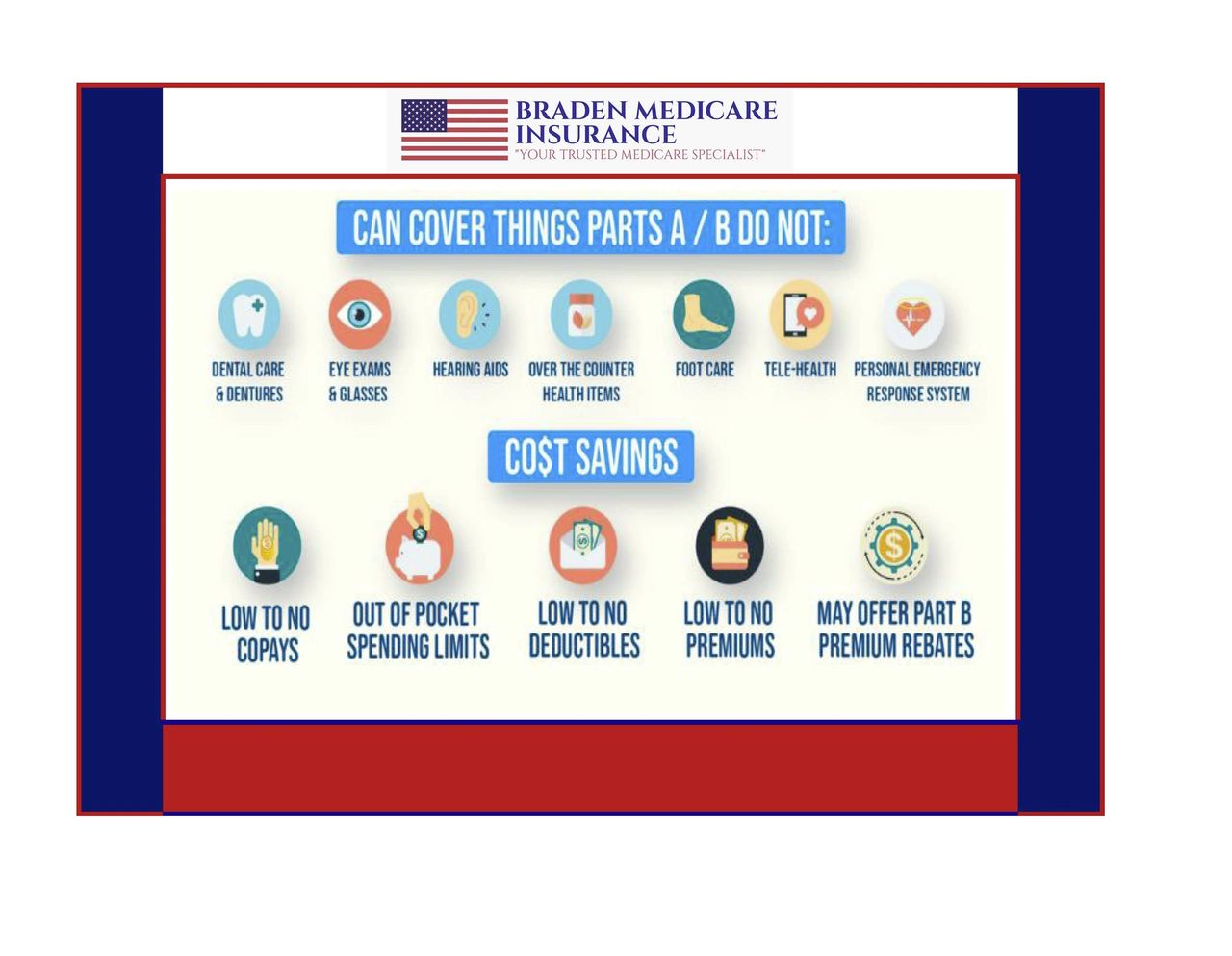

MEDICARE PART C = MEDICARE ADVANTAGE PLANS

Medicare Part C is otherwise known as Medicare Advantage. Private insurance companies that Medicare approves offer Medicare Advantage plans. If you enroll in Medicare Part C, it will become your primary coverage over Original Medicare.

Medicare Advantage plans combine Medicare Part A and Part B coverage with additional benefits to provide you with what is often referred to as an All-In-One Plan. However, carriers offering these plans set their own co-payments, deductibles, and maximum out-of-pocket limits.

Medicare Part C may offer dental, vision, and hearing care, along with transportation to doctor's appointments, and gym memberships. These benefits are not available with Original Medicare.

Medicare Part C plans have low premiums and many HMO plans have $0 premiums.. But, even with the low monthly premium, you may spend more with Medicare Part C because of high out-of-pocket limits and cost-sharing. Additionally, you will still need to pay the Medicare Part B deductible when you have Medicare Advantage coverage.

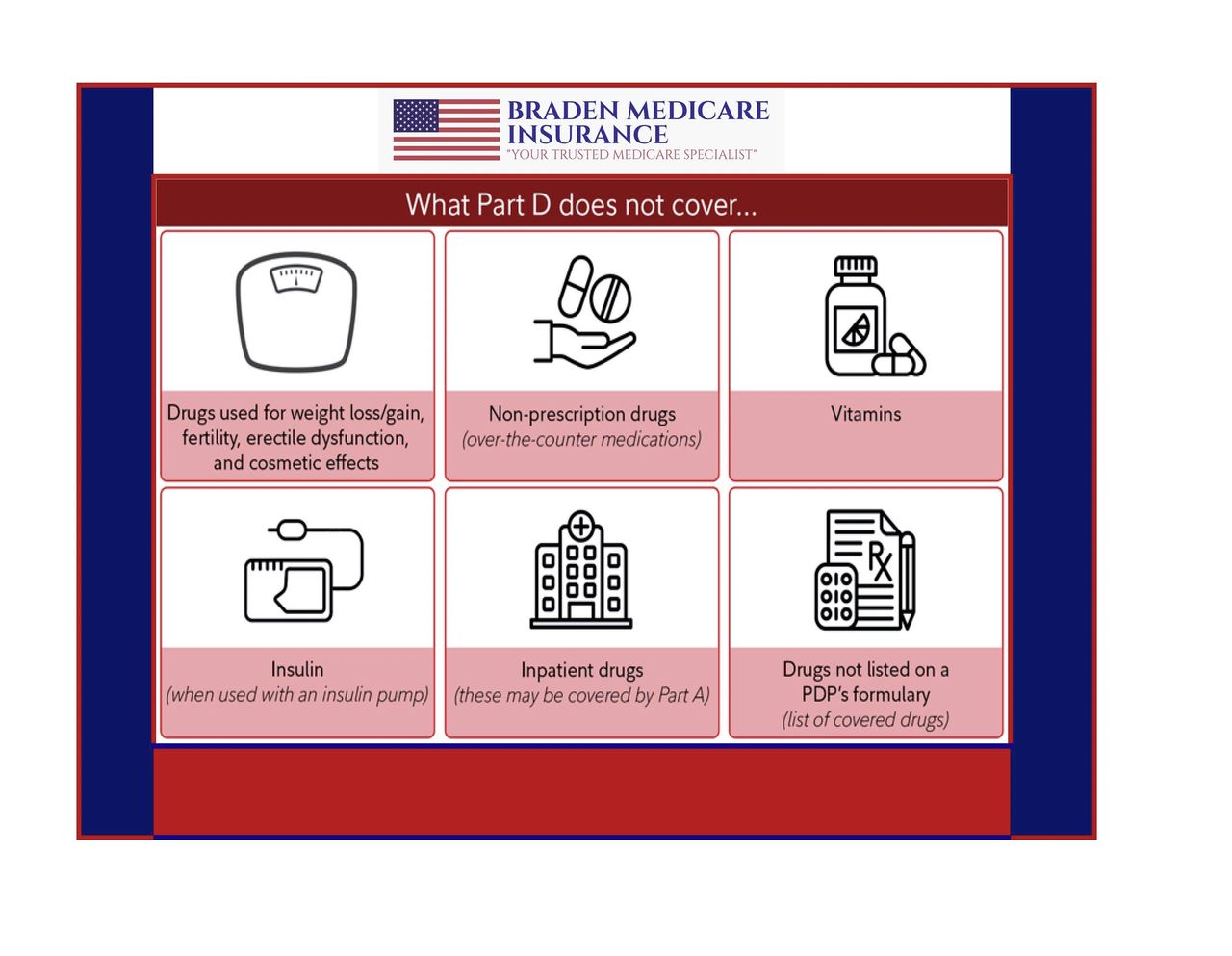

MEDICARE PART D = PRESCRIPTION DRUG COVERAGE

Medicare Part D is prescription drug coverage. This part of Medicare helps cover the costs for medications your physician may prescribe for you to take at home. Like Medicare Part C plans, private insurance companies approved by Medicare offer these policies.

If you have Original Medicare, it is essential to sign up for a Medicare Part D plan to receive prescription drug coverage. If you delay your enrollment in Medicare Part D and do not have creditable drug coverage, you may need to pay the Medicare Part D penalty in the future.

The average Medicare Part D plan in 2024 costs $34.70 per month. However, plans are available for as low as $5 in some areas. It is crucial to obtain drug coverage, as we never know when we will require medications to maintain our health.

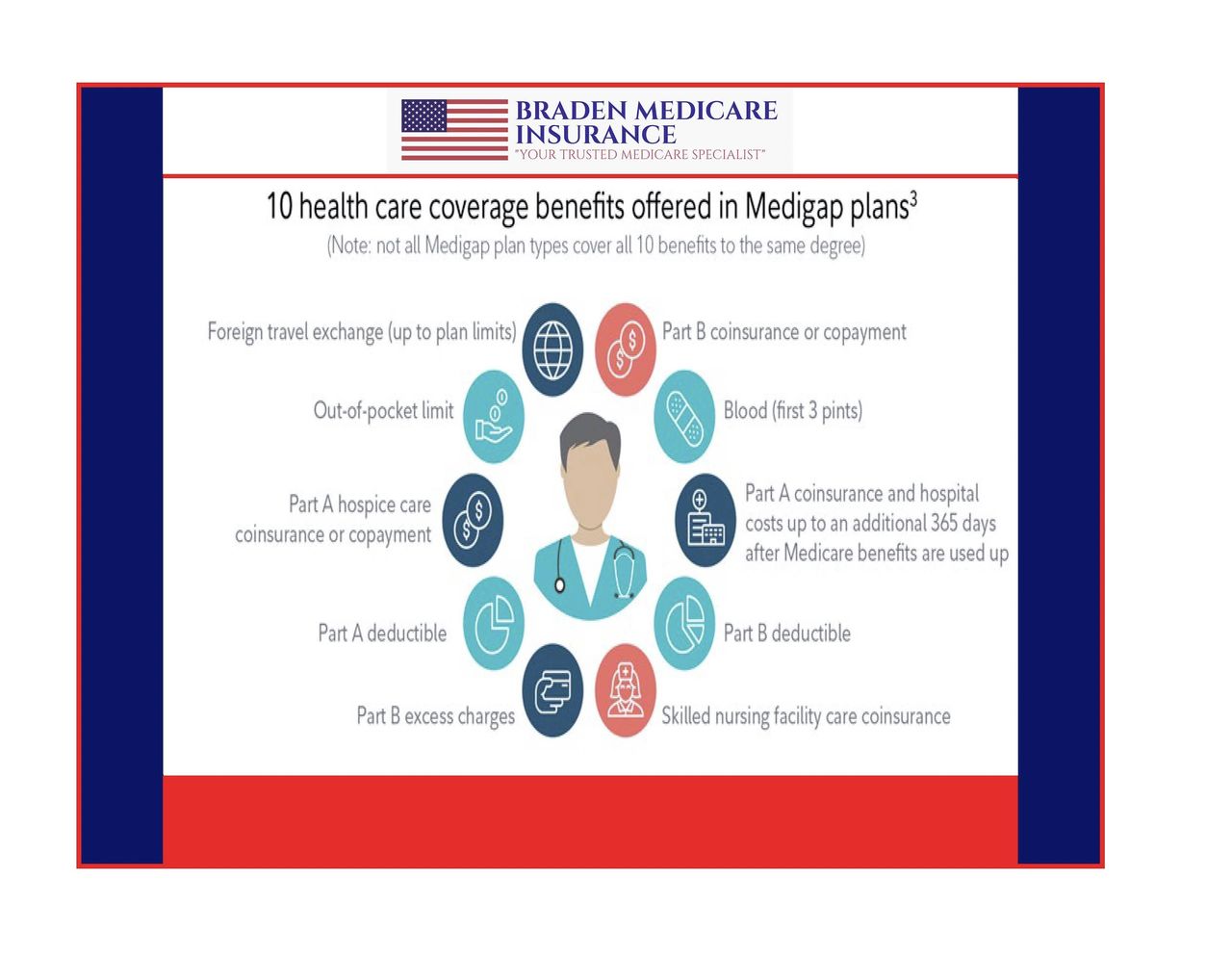

MEDICARE SUPPLEMENTS & MEDIGAP ARE THE SAME THING

Medicare Supplement (Medigap) plans are not an official part of Medicare. However, they are made to be secondary to your Original Medicare coverage.

Medicare Supplement plans are federally standardized to match specific criteria. Thus, the same policy – regardless of the carrier – must provide you with the same benefits.

There are 12 available standardized Medicare Supplement plans in most states. However, not every option may be available to you. You must ensure you meet the qualifications before enrolling. Each plan has its own benefits to help you cover your healthcare costs.

Since Original Medicare only covers 80% of your costs, Medigap plans cover some or all of the other 20%. And, most of the most popular plans will cover all of your 20% share is leftover from Original Medicare.

Remember, that if you enroll in Medicare Part C, you cannot enroll in a Medicare Supplement. That is why it is important to take the time to compare all available coverage options to ensure you choose the best one for you.

Like Medicare Part C, Medicare Supplement plans have a monthly premium you must pay to continue your coverage each month. Monthly premiums; range from $50 to $450, depending on the plan.

ITEMS NOT COVERED BY ORIGINAL MEDICARE

The four parts of Medicare do not cover everything. Medicare Part C can cover many benefits that Original Medicare does not.

Services not typically covered by Medicare include:

- Hearing aids and hearing exams

- Most dental care/dentures

- Long-term custodial care

- Routine eye exams/glasses

- Cosmetic surgery

- Acupuncture

- Routine foot care

If you have Original Medicare, you can still enjoy most of these services by enrolling in a stand-alone plan to cover the benefits you desire.

ENROLLING IN MEDICARE

Not everyone can obtain Medicare coverage. You must meet specific criteria for the federal health program. You must meet at least one of the following:

- Age 65 or older

- Receive Social Security Disability Income (SSDI) for 24 months

- Diagnosed with ALS or ESRD

Additionally, you must be an American citizen for at least five years. Many people automatically enroll in Original Medicare once they turn 65.

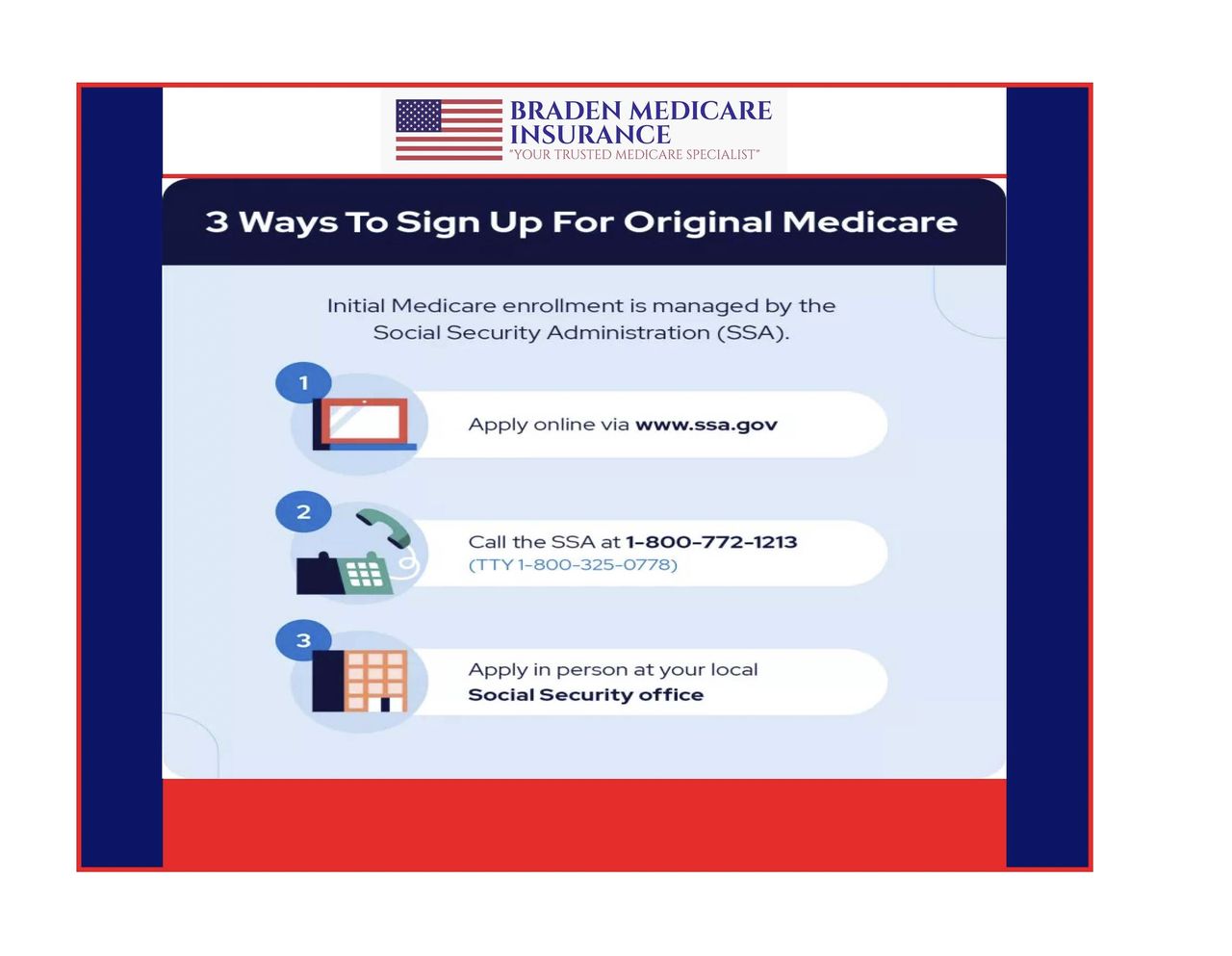

However, you may need to enroll yourself in Medicare through the Social Security Administration. If you are not receiving Social Security benefits when you enroll in Medicare, this will be the case for you. You should enroll when you first become eligible to avoid any late enrollment penalties in the future.

WHAT TO DO IF YOU ARE NEW TO MEDICARE

If you are new to Medicare or are recently eligible for the federal health program, you will want to begin by enrolling in Original Medicare.

Typically, those new to Medicare will enroll in Original Medicare upon their 65th birthday. Around this time, you get an Initial Enrollment Period when you can enroll in Medicare Part A and Part B.

There is no rule that says you must enroll in Original Medicare. However, if you do not enroll or have creditable coverage in the meantime, you must pay a penalty if you eventually enroll in Original Medicare.

For most, Medicare Part A has a $0 monthly premium. If you work at least ten years in the U.S. paying Medicare taxes, you will not owe a Medicare Part A premium as long as you have this coverage.

On the other hand, Medicare Part B involves a premium for everyone. In 2023, the base Medicare Part B premium is $164.90, which has increased to $174.70 for the year 2024. However, this can increase based on your income. Higher earners may need to pay a higher Medicare Part B premium. On the other hand, those with lower incomes may qualify for assistance programs that partially or fully cover their Medicare Part B premium.

WHAT TO DO IF YOU ARE NEW TO MEDICARE AND INTERESTED IN MEDICARE SUPPLEMENT PLANS?

After you enroll in Original Medicare, you have the chance to pair this coverage with a Medicare Supplement plan. Medicare Supplement plans pay secondary to Original Medicare and fill the gaps in coverage and out-of-pocket costs.

When you are new to Medicare, you may not understand all the costs associated with Original Medicare. These costs change annually, so it is essential to stay as up-to-date as possible.

Medicare Part A requires you to pay a per-occurrence deductible and per-day co-payments when you stay in the hospital past the allowed number of days. Meanwhile, you must pay an annual deductible and a 20% coinsurance on Medicare Part B.

This is where Medicare Supplement (Medigap) plans can help significantly. These plans relieve you of out-of-pocket costs, making your healthcare more affordable.

When you are new to Medicare, you receive a Medicare Supplement Open Enrollment Period. This means that you can enroll in any Medigap plan, regardless of your pre-existing conditions.

Your open enrollment window for Medigap is unique to you, but it only lasts six months. Once it is over, you can still enroll in a Medigap plan at any time, but you will need to go through medical underwriting when doing so.

Thus, it is crucial to enroll in a Medicare Supplement plan as soon as you are eligible. It may be your only opportunity.

Once you have Medigap, you can receive care from any health professional that accepts Original Medicare. Because benefits are standardized, your carrier does not impact the doctors you can visit. Additionally, you will never require a referral to see a specialist.

WHAT TO DO IF YOU ARE INTERESTED IN A MEDICARE ADVANTAGE PLAN?

If you choose not to enroll in a Medicare Supplement plan, the next best option is a Medicare Advantage plan. However, you cannot enroll in both plan types simultaneously. You must only choose one.

Medicare Advantage, or Medicare Part C, are all-in-one Medicare plans that provide additional benefits to Original Medicare. These benefits can include dental, prescription, hearing, vision, and transportation coverage, as well as gym memberships and more.

Enrolling in a Medicare Advantage plan often comes at no additional monthly cost to you. However, you must still pay your Medicare Part B premium each month. Additionally, these plans often have higher maximum out-of-pocket limits. These limits can be as high as $10,000 or more if you go out of network.

This coverage type is often more restrictive than Medicare Supplement plans, so more clients tend to enroll in a Medigap plan to save money in the long run.

Hopefully, you now feel more familiar with the different parts of Medicare and what each includes. We understand it can be overwhelming and confusing at first, so we’re here to help you find the information you or your loved ones need.

Not only are we an online Medicare learning resource, but we can also help you find the best rates for the above types of coverage!

WRAPPING THINGS UP

To receive an online premium comparison, call us at the number above. Or, complete a request on our Contact Braden Medicare Page to find a policy or plan near you. We never charge a penny for our services and it would be our honor to assist you with all of your Medicare needs..

ALWAYS AVAILABLE WHENEVER YOU NEED US

We help hundreds of Medicare Beneficiaries every year. And, we would be happy to answer any questions you have about Medicare, Signing Up For Medicare, Original Medicare, The Four Parts That Make Up Medicare, Medicare Advantage, Medicare Special Needs Plans,Medicare Part C and IRMAA.

Please feel free to either visit our website, email us or just pick up the phone and give us a call. We are always happy to make a new friend and we genuinely love to help people!